Any rate hikes by the Fed or any hawkish statements are viewed as bearish for CAD, which struggles to compete with high-yield bearing assets in rising rate environments. USDCAD was almost unchanged at 1.3165.

Sentiment on the commodity currencies remained fragile amid lower crude prices on Tuesday, as global supply glut concerns overshadowed rumors of a potential agreement among exporters to freeze output.

1M ATM IVs are trading a shy above 15%, skews are suggesting the odds on OTM call strikes while formulating below option strategy for gold's uncertainty at this juncture.

Option strategy:

Favour optionality to directional trades. We are inclined to position for a partial retracement of the down move through call spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Call spreads are preferred to vanilla structures given elevated skew and favorable cost reduction.

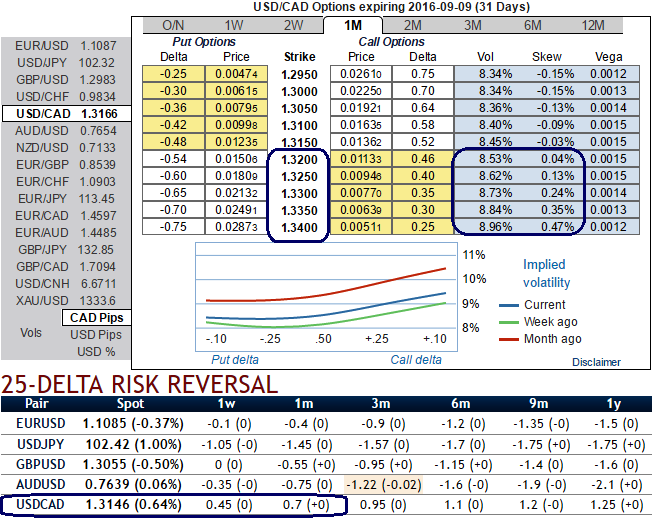

Buy USDCAD 1w call spread with strikes of 1.3250-1.3083 for a net debit.

The net delta of the position should be around 44 (0.65 ITM strike = 71 delta) and selling the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

The Black-Scholes IV curve is asymmetric in the overall sample, displaying a rising pattern with moneyness, and 1W and 1M risk reversals are signaling a sharp upside risk in the risk-neutral distribution of returns. Also, the IV curve is at, or slightly decreasing, with maturity.

Maximum gain is achievable when underlying spot FX move above OTM strike with ideal risk-reward.

By shorting the out-of-the-money call, the options trader reduces the cost of establishing the bullish position but forgoes the chance of making a large profit in the event that the underlying asset price skyrockets.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics