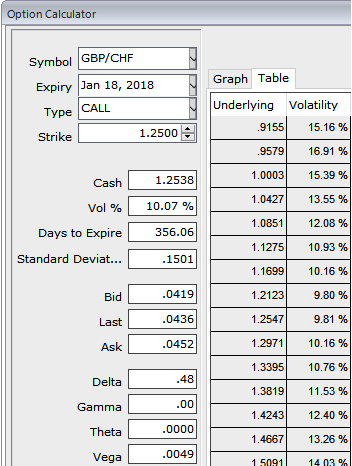

GBPCHF back-end volatility: 1Y -2Y GBPCHF straddles strike us as an exceptional defense against Brexit chaos, for a few reasons:

a) GBPCHF vols have retraced nearly all the way back to their post-referendum lows (refer above chart), so appears to price in the sort of benevolent post-Brexit scenario that was widely spread in Q3’16.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. Unfortunately, if you have sold an option, it is bad. A seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

This complacent vol pricing owes in large part to elevated GBP vs. CHF correlations via USD (north of 50%) thanks to the post-US election broad-based dollar surge, but is prone to a sharp breakdown either in the event of idiosyncratic UK political stress and/or a broader risk aversion.

b) At 10.4 in 1Y and 10.6 in 2Y (mids), GBPCHF offers relative value edge over vanilla GBPUSD vols that trade 8/10th of a vol over, even though long run historical beta between the two is nearly 1.

This relative pricing reflects the current regime of CHF inertness driven by persistent SNB intervention in the franc and is locally fair vis-à-vis day-on-day realized spot volatility, but not for a less orderly environment of above-average spot moves when local elasticities can come unhinged.

After Q1’15's de-peg experience, it is prudent to be long protection against discontinuity risk in SNB’s currency policy, especially when it does not entail paying a material premium.

c) While daily realized volatility in GBPCHF is not remarkable, the mild slope of the 1Y-2Y vol curve mitigates theta decay, which in any case is not onerous for options that far out in tenor.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?