The fundamental forces contributing to the less pessimistic view of EURUSD now are threefold:

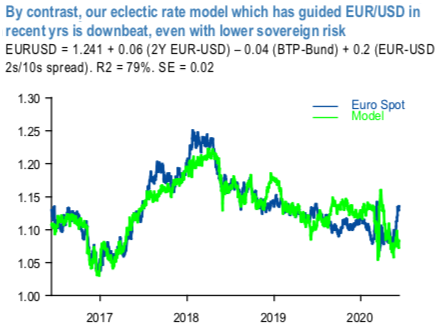

First, the proposals for a degree of fiscal burden sharing through the EU’s recovery fund (circa 5% of regional GDP spread over four years) have at the very least deferred the risk that a renewed wave of sovereign stress and/or populism in the periphery could compromise the integrity of the single currency once again, even if it is premature to conclude that this breakthrough definitively sets the region on the path to a fully-fledged fiscal union that would eliminate this existential tail risk once and for all. The recovery fund still faces opposition from the frugal four group of northern European countries and could yet be diluted in terms of a reduction in the 2:1 ratio of grants/loans (the EU Council meeting on June 19th is not expected to reach an agreement on the fund). The 70-80bp tightening in peripheral spreads have contributed 2-3 cents to the upgrade to the EUR forecast (refer 1st chart).

Second, the domestic political tail-risk to USD is increasing just as it is subsiding in the Euro area to judge from the narrowing in the odds on a Biden presidency and the potential for less-centrist policies under Biden compared to the pre-epidemic baseline.

Third, the market’s impressive/ blinkered (delete as appropriate) optimism about the global recovery could persist for a few more months yet as global data turns higher, before legitimate concerns about the quality and extent of the recovery are able to get a look- in; this optimism could continue to pressure USD generally and so support the desire of fund managers to neutralize long-standing EUR underweights.

But whereas these factors justify raising the EUR targets, we do not believe that they warrant an outright bullish trajectory for EURUSD. Crucially, the prospects for a sustained improvement in European growth remain highly contentious, so too therefore the possibility that EUR could repeat its 20 cents surge in 2017 when the Euro area temporarily took over as the engine of global growth (note that the ECB projects the economy to be 4% smaller by the end of 2022 than the pre-Covid baseline, even with its additional policy support).

Moreover, the post-Covid recovery in the global economy is also liable to remain incomplete (even without the risk of a second Covid wave) and so provide residual, medium-term support for USD irrespective of the Fed’s commitment not to hike until at least the end of 2022. The path to economic redemption, and hence a dramatically softer USD and stronger EUR, will be far more tortuous than either the post-Y2K experience when the USD REER shed 26%, or the post- GFC recovery when USD dropped 17%.

As things stand, EURUSD is already 1% above its 5Y average; for EUR to appreciate towards the 10Y average at 1.21 would likely require much greater clarity than investors currently possess about the durability of the global recovery, let alone the ability of the Euro area to more fully participate in this upswing than it has done in the past decade. Similarly, it is hard to imagine that the ECB will not maintain a looser monetary stance than the Fed for quite some time (the EUR curve prices only 10bp in hikes by mid-2024; the USD curve is double that). Negative rate differentials and the potential for excess QE will remain medium-term headwinds for EURUSD, we suspect. We expect the ECB to add another €750bn to PEPP in 4Q’20, to take its QE programme to a chart-busting 23% of GDP (refer 2nd chart).

Trading tips: At spot reference: 1.1243 levels (while articulating), although we see some cushion at 7 & 21-DMAs for today, contemplating short-term technical that indicates intraday selling sentiments, one can execute tunnel options spread strategy. Such exotic option with upper strikes at 1.1293 and lower strikes at 1.1168 levels likely to fetch exponential yields than the spot moves. The strategy can get assured yields as long as the underlying FX keeps dipping but remains well above lower strike.

Alternatively, we recommended shorts in EURUSD futures of July’20 delivery for the major downtrend, we now wish to uphold these positions on hedging sentiments. Courtesy: JPM

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays