Bearish EURUSD Scenarios:

1) A second Covid-19 wave undermines risk markets and does further damage to EUR public finances.

2) Dilution of the EU recovery fund to favour more loans/fewer transfers.

3) UK leaves the EU at year-end with no trade deal.

4) GCC blocks Bundesbank participation in QE.

5) The emerging health stabilization and economic reopening stumbles on second-waves, or unexpected aftershocks that drive a second, further dip. US-China tariff war restarts.

Bullish EURUSD Scenarios:

1) EU agrees the current recovery fund proposals.

2) All countries tap the ESM facility and the ECB stands ready to activate OMT.

3) The UK extends the Brexit transition period.

4) Quicker than expected resolution of the COVID-19 crisis via comprehensive health

solution (treatment & vaccine) allowing a quicker economic recovery.

OTC Updates:

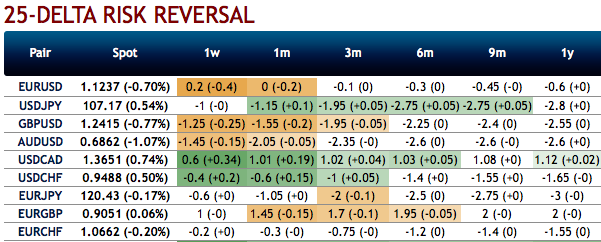

EURUSD risk reversals are trading positively again for tenors below 1-month, and at almost zero for 1-month (refer 1st chart). Is that because the dollar less suited as a safe-haven? Perhaps marginally. Above all because the market is considering the risk of a second wave of the pandemic to be low and considers a major, risk-driven slide in EURUSD to be less likely. Otherwise butterflies would not be virtually back at pre-corona levels. That might be sensible pricing levels for all those market participants who can spread their risks. Anyone not able to enjoy that luxury might be pleased about this good opportunity to hedge non-diversified risks against a renewed wave of risk aversion.

EUR risk reversals of 3-months tenors and above have still been indicating the hedging sentiments for the bearish risks in the long run, as the fresh negative bids are added to the positive RRs for 3m-1y tenors.

Most importantly, the positively skewed EURUSD IVs of 3m tenors are stretched on either sides but with slight biasness towards downside hedging risks (refer 2nd chart), while IVs are spiking above 7.5%. Hence, considering all these factors, the below options strategies are advocated.

Options Strategy: Contemplating above factors, activated 1m butterfly spread on trading grounds. Initiated longs in 1m OTM -0.49 delta put while simultaneously shorting ATM put with similar expiries and buy 1m OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as EURUSD is perceived to have a low volatility.Courtesy: Sentry, Saxo & JPM

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty