USDJPY forecast is trimmed with no change in the big picture. JPY has gained more than 3% in trade-weighted terms and appreciated against other G10 currencies. The BoJ policy meeting is scheduled on Wednesday, and is the main Japanese event this week, with most focus on the Policy Board’s updated economic forecasts. Some disappointing activity data – especially the lower base provided by the Q3 GDP report – will require a downward adjustment to its forecast for growth, at least for FY18 (currently 1.4%Y/Y). The inertia of underlying inflation, step down in oil prices, and government plans to abolish pre-school education fees, demands a downwards revision to the BoJ’s inflation projections. In our view, the Bank’s forecast for core CPI in FY19 of 1.4%Y/Y (excluding the impact of the consumption) could be as much as 1ppt too high. But the updated Outlook Report will likely see the Board’s median view nudged only modestly lower, with comfort still taken from its estimate of a positive output gap and tight labor market. So, the BoJ will remain constructive about the medium-term inflation outlook, albeit still reluctant to place a date on when the current 2% target might actually be achieved.

Meanwhile, USDJPY started its downward trend in mid-December with growing concerns about global economic slowdown and risk asset sell-offs.

USDJPY started this year at 109-handle, followed by a sharp decline to 104.10 on January 3 this year, and was temporarily back to the pre-flash crash level this week.

The appreciation of JPY since December was not something we had expected. Outside FX markets, risk asset markets started to aggressively price in a global economic slowdown, and we saw more than 15% decline in S&P500 from its high to the bottom in December (though it recovered 10% already). With the market volatility, Fed Chair Powell has shifted to a more dovish stance, emphasizing uncertainties and downside risks to global growth and a cautious assessment of global financial market developments.

FF future markets now even price in the possibility of a rate cut by the Fed this year. Given the dovish shift of the Fed and the developments in the financial markets, our economists now look for two hikes by the Fed this year (originally three hikes were expected).

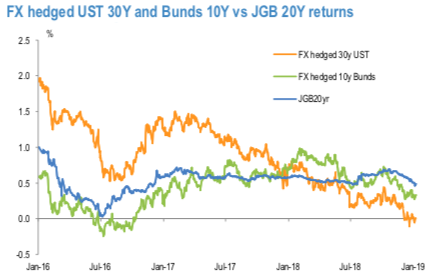

Furthermore, our rates research teams revised down their forecasts of UST and JGB 10Y yields to 3.20% and 0.10% respectively. Courtesy: Bloomberg, JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at -57 levels (which is bearish), hourly USD spot index was at 161 (bullish) while articulating at (09:41 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data