The recent developments support currency gains but lingering risks should weigh down MXN toward year-end. Over the past weeks, data and news flow have been largely positive. US rhetoric around NAFTA renegotiation has turned more constructive, growth appears to be on a stronger footing than we thought, and fiscal consolidation—which will be aided by transfers from the central bank to the government worth 1.5% of GDP—is on its way.

All of the above could prevent a credit rating downgrade, which we continue to expect later this year.

No downgrade could provide a boost to the currency, which has already strengthened in part on higher carry-to-vol stemming from rate hikes and FX intervention. But the fact that NAFTA renegotiations might not be linear, and local political risks are likely to arise in 2H17 suggests MXN should lose some luster toward year-end.

Hedging Strategy:

After weekend’s correction in USDMXN from the highs of 19.9440 levels, the pair takes support at around 18.60 levels, but for now, more slumps seem to be likely to resume its previous bullish trend, the major uptrend still appears to be robust and likely to prolong further.

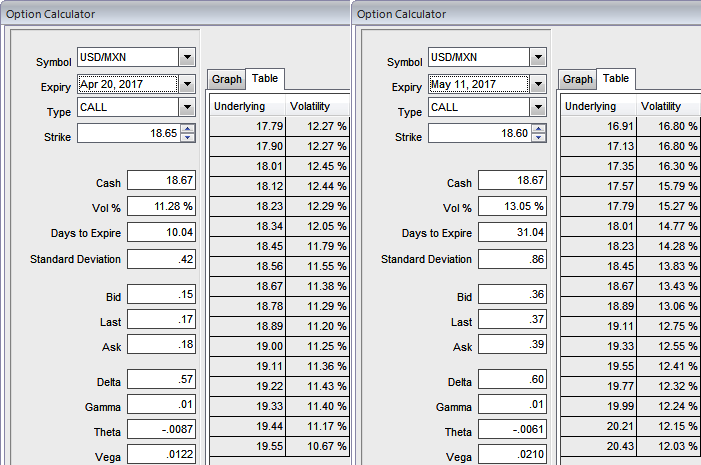

While ATM IVs of this pair is substantially spiking higher above 11.28% and 13.05% for 10d and 1m tenors which is conducive for the holders of the call options, but using the minor dips in this underlying pair writing narrowed tenor OTM calls would reduce the cost of hedging.

Thus, using any abrupt dips, initiate a diagonal credit call spread (DCCS) at net debit.

The execution: Initiate shorts in 1W (1%) in the money calls with positive theta, simultaneously, buy 1M at the money 0.51 delta call option. Establish this option strategy if USDMXN spot FX is either foreseen to be in sideways or spike up considerably over the next month.

On the flip side, dips momentarily but certainly not beyond your upper strikes in short run.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays