The potential of trading live (non-delta hedged) FX options is explored based on a well-known and broadly used FX cash leading technical indicator: stochastic oscillator index. The idea is that stochastic indicator can spot early signs of slowing or reversals in trend that consequently can be capitalized via rich universe of directional FX option structures.

“Buy” (“sell”) reversals are signalled when the indicator is below 40 (above 60) and is exhibiting higher lows (lower highs). Option trades (non-delta hedged) are entered on the following trading day and held to maturity.

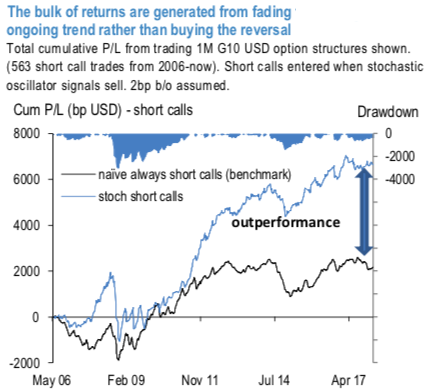

The back-test (2005-present, conducted on G10 USD pairs as one basket and EM pairs as the other basket) shows that by using stochastic oscillator reversal points to time trade entry into short-tenor directional option structures, long- term cumulative returns can be boosted by more than 100bps per year (refer 1stchart).

Notably, a sizable portion of the observed returns comes from fading momentum of an existing trend. This makes selling put options on “buy” signals and selling call options on “sell” signals along with owning risk reversals on "buy" and selling them on "sell" signals two favorable expressions that utilize stochastic oscillator (refer 2ndchart).

In the G10 space, most recently stochastic oscillators indicated:

1) The bullish reversal for USDCAD on Aug 2, AUDUSD and EURUSD on Jul 20, NZDUSD on Jul 16 and GBPUSD on Jun 29 – best expressed via long 1M risk reversals or short 1M ATM puts.

2) The bearish reversal for USDNOK on Jul 27, USDCAD on Jul 20, USDCHF on Jul 16, USDJPY on Jul 3 and USDCHF on Jun 29 – best expressed via short 1M risk reversals or short 1M ATM calls. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 65 levels (which is bullish), while hourly USD spot index was at 17 (neutral), NZD at 138 (bullish) and CAD at -165 (bearish), while articulating (at 12:32 GMT). For more details on the index, please refer below weblink:

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential