A no-deal Brexit is off the agenda - for the end of October anyway. But unless a final decision on Brexit is taken, either for or against it, or with or without a deal, we consider the current quiet on the markets to be fragile; in particular as things are beginning to move a little again. Prime Minister Boris Johnson has now suggested holding general elections on 12th December, literally at the earliest possible date. He will propose this motion to Parliament on Monday.

But as was the case with his withdrawal agreement, this idea too is meeting opposition. The Labour Party for example is insisting that the extension of the Brexit deadline should initially be finalised before they can agree to elections. The markets are likely to watch with interest who is going to cave in this time. Johnson’s record so far suggests that it is going to be him.

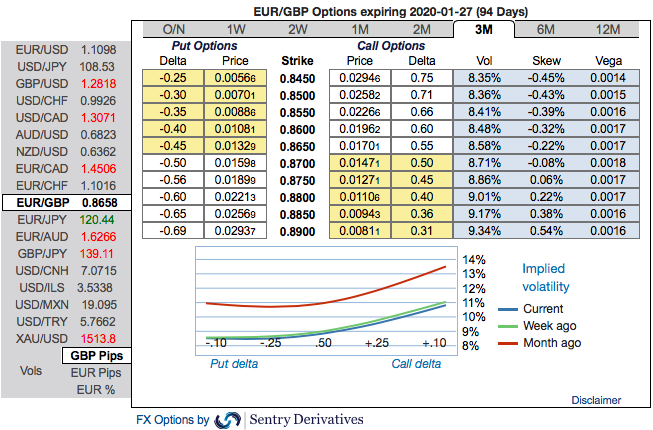

Well, if elections really are going to be held by the end of the year we would expect to see increased volatility in the GBP exchange rates in the run-up, in particular a renewed rise in implied 1-2 month volatilities seems almost a given.

This double-header of favourable political developments (the US-China trade sentiments in addition to a Brexit deal) in the near future could herald a tactical turn for the better in the general risk climate.

Hence, our defensive stance in EURGBP has been dictated by the receding global economic tide, but we cannot ignore that political risk has been an instrumental factor in these worse macro outturns. This warrants a tactical reduction in our defensive exposure but we uphold our hedging portfolios via 3-way straddles.

The passively skewed IVs of 3m tenors are stretched are indicating upside risks, more bids are observed for OTM call strikes up to 0.89 level.

While EURGBP risk reversals of the existing bullish setup remain intact with mild bearish shift, you see minor negative risk reversal numbers in the shorter tenor, but it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid the expected turbulent condition. According to the OTC FX surface, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM calls of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix, Saxo & Commerzbank

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data