Sterling appears to be untradeable and remains in the firm grip of the ongoing Brexit drama, but the British currency seems to have discounted most of the bad news on current levels.

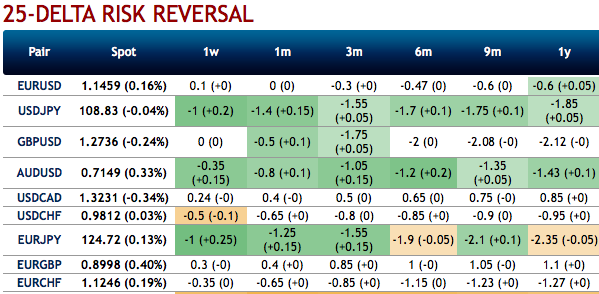

We have seen fresh positive shift in GBPUSD negative risk reversals, but IV skews have still been indicating bearish risks. Hence, mild rallies may be expected despite broad based bearish outlook.

We positioned for a modest but with a pinch of salt albeit distinctly bounded relief rally in GBP through a ratio put spread.

We hold a legacy put in EURGBP but without any visibility or insight as to how the political logjam over Brexit will be cleared.

Yesterday’s vote in the House of Commons, that now makes it more difficult to (financially) prepare for a disorderly Brexit, illustrates: an increasing number of MPs, also from amongst the Conservatives, are no longer willing to be impressed by the Prime Minister’s threat of a no deal – they simply do not want it.

The debate on the EU withdrawal agreement in the House of Commons today will be kicked-off by Brexit Secretary Stephen Barclay. The “meaningful vote” is now confirmed as next Tuesday evening (15th January).

According to reports, the UK government is continuing to seek new assurances from the EU on the Irish backstop, while also denying it is seeking an extension of Article 50 (to delay Brexit) if the deal is voted down next week.

Last night, the government was defeated on amendments to the Finance Bill, which may suggest that a ‘no deal’ Brexit will be more difficult to implement.

A positive vote about the exit agreement with the EU next week has nonetheless not become any more likely, instead May has merely lost scope to act. So please do not go ahead and buy Sterling hoping that a no deal Brexit has become less likely following yesterday’s vote. Beware of false hopes. Courtesy: sentrix, saxobank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing at -64 levels (which is bearish), hourly USD spot index was at -56 (bearish) while articulating at (10:11 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields