The GBP forecasts are downgraded in order to mirror less favorable cyclicals (the fragile growth among G10, the less probability of a near-term rate hike) and also to lodge the upward revisions to the EURUSD forecast. While the forecast for EURGBP is lifted from 0.92 to 0.93-94 by the end-2017 vs 0.90.

The projection ponders over a beta between EURGBP and EURUSD close to the long-term average near 0.5% (the 1Y forecast for GBPUSD is 1.34). There is naturally some focus on whether EURGBP could reach parity but we regard that as being much too aggressive in the absence either of an outright UK recession or the failure of Brexit negotiations that heightens the risk of a disruptive Brexit in 2019 (we have rather cut the probability of a hard Brexit defined by WTO rules from 25% to 15%), sources as per JP Morgan.

OTC Outlook and Options Strategy:

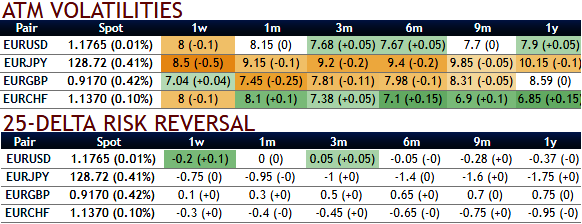

The implied volatility of ATM contracts for near month expiries of EURGBP is a tad below 7.5%, it has remained below 8% across 1-6m tenors, these tepid IVs among G10 FX space appears to be conducive for overpriced call option writes in bullish hedging strategies as the delta risk reversals are also flashing bullish neutral numbers that signify hedging arrangements for upside risks amid minor corrections over the period of time.

While the current IVs of ATM contracts are at higher levels but likely to perceive hover around at an average 8-8.5% in the long run that would divulge pair’s gain contemplating risk reversal arrangements.

Contemplating above OTC market reasoning and fundamental factors we think further upside risks are on the cards, as result we reckon deploying longs on ATM call option with delta being at around +0.51 in hedging strategies are worthwhile and to reduce the cost of hedging we would also like to write over OTM puts as the northward forecasts remain maximum upto 0.94 mark.

Please be noted that the 2m 2% OTM calls are trading at around 14% more than the NPV of this option, while IVs just between 7.4-7.7%. We see this disparity as an optimal opportunity to be utilized for shorts with a view to reducing the cost of hedging.

Hence, hold a 2-month 0.9025-0.9410 EURGBP call spread, marked at 0bp.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?