If a currency had a soul, we would feel sorry for Sterling. First the Brexit risk and now (that the no deal risk is almost off the agenda) the Corbyn risk.

We don’t want to go down the route of simple Socialist bashing, but we have to accept that the UK is in a structurally fragile position. The country’s current account deficit amounts to a breath-taking 5% of GDP. That means every day the UK economy has to find someone to give it an additional loan worth GBP 300m for the party to continue. In a situation such as that it is not clever to put off one’s creditors, for example by electing someone who would - cautiously put - make an unconventional Prime Minister. The price to pay for continuously living above one’s means is to lose one’s scope to act, sometimes the political scope.

At present, Sterling benefits from anything that lowers Labour’s chances of winning the election. A Labour victory seems rather unlikely. But political forecasts have to be seen as rather unreliable in the UK, as we all learned the hard way in the last years. It is, therefore, understandable that the FX market behaves as it did with the Brexit risk: very little happens in the GBP exchange rates but the volatility (its levels and risk reversals) reflects increased event risk.

OTC Updates:

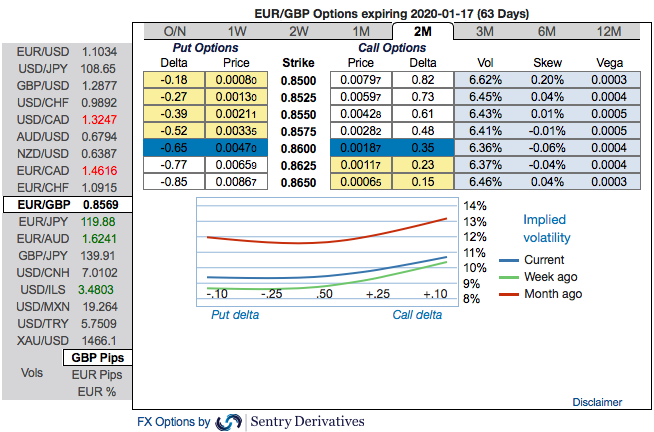

The passively skewed IVs of 2m tenors are stretched are indicating upside risks, more bids are observed for OTM call strikes up to 0.89 level.

While EURGBP risk reversals of the existing bullish setup remain intact with freshly added mild bearish shift, you see minor negative risk reversal numbers in the shorter tenor, but it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid the expected turbulent condition. According to the OTC FX surface, 3-way options straddle versus ITM calls are advocated seem to be the most suitable strategy for EURGBP contemplating some OTC sentiments and geopolitical aspects.

Options Strategy: The strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short (1%) ITM calls of 1w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix, Saxo & Commerzbank

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays