Being right or wrong doesn’t matter as long as your portfolio is able to generate positive cash flows as per George Soros.

But this time the billionaire and legendary investor went wrong, whose 1992 flutter against the British currency made hedge fund history, has not repeated the history, the bet ahead of sterling’s record tumble on Friday went in vein.

Whereas, FxWirePro had consistently been anticipating and advocating hedging bearish risks of the sterling crosses.

Below are a few samples where we’ve advised to stay short in GBPUSD, the importers and exporters in the long-term who have deployed these hedging strategies, by now they would have saved in the steep tumble of GBPUSD trend.

Please follow the below link for our previous articles:

For now, although some momentary gains are expected, it wouldn’t be deemed them as long opportunities but a speculation.

We would still foresee some more weakness leftover in this pair as a result post-referendum effects, even though outcomes are out, it takes minimum 1 year to settle down the formalities before actual exit takes place.

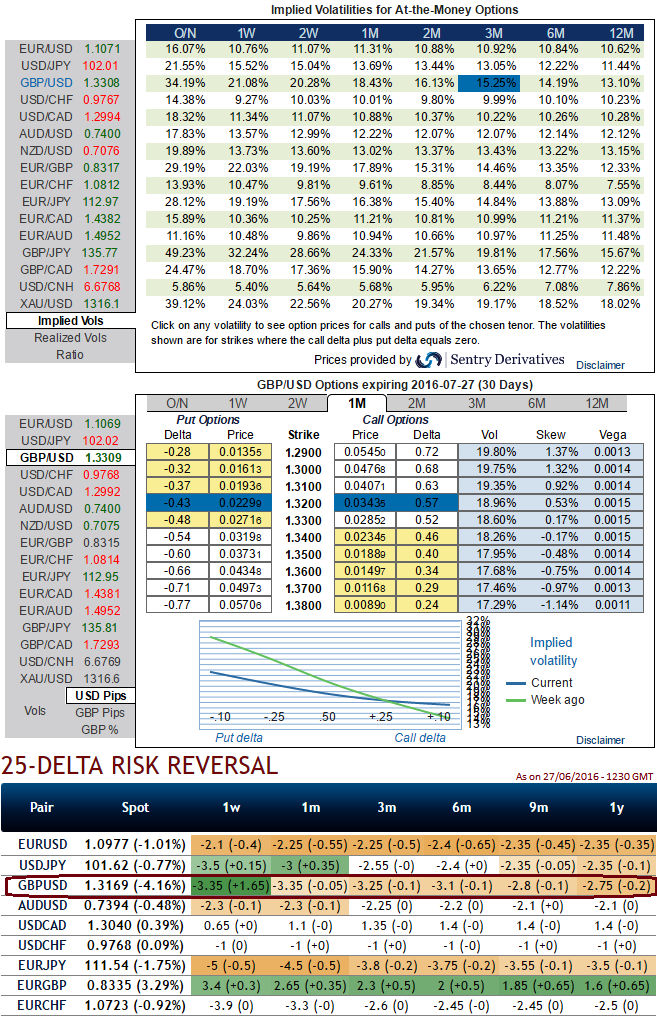

As a result, we recommend a GBP/USD 1-3M risk reversals that signify more bearish risks in this pair i/o 1Y as a generic hedge for Brexit risk and stay calm with bearish hedging vehicles as advocated before.

The ideal entry point is not ideal given the near doubling of the risk reversal since early October, but the bias is for further widening of the skew in slightly OTM strikes on persistent-bleed demand for post event protection.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields