- The Brexit saga continues to unfold with one intrigue after another.

- After this week’s developments, markets are pricing in either a soft-Brexit with some delay or perhaps even no Brexit.

- PM May’s narrative has shifted; the argument now is that saying no to her deal with EU would amount to no Brexit at all.

- The possibility for a long delay and the rejection of a second referendum could see a push for new elections and fresh volatility.

- In the unlikely event of a no-deal Brexit, the market impact would be extremely negative.

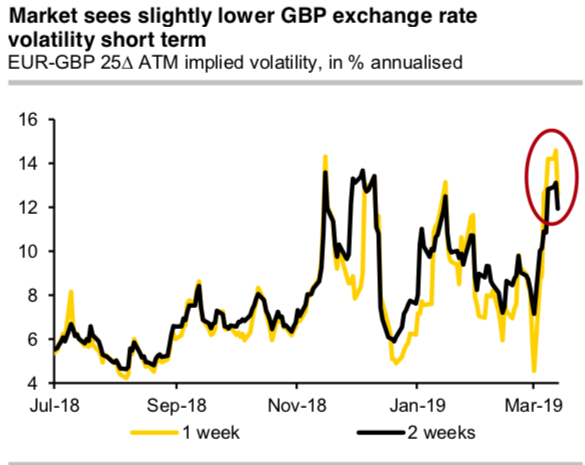

Contemplating all the above aspects and foreseeing upcoming risks events, the shoot-up in the exchange rate volatilities priced in on the FX options market for the coming two weeks might, therefore, turn out to be premature (refer 1st chart). Please be noted that implied volatilities are highest for GBPUSD (1st nutshell), OTM volumes index is also the highest (refer 2nd chart) with fresh positive additions to the bearish risk reversals (2nd nutshell) across all the tenors.

Otherwise the situation for Sterling has changed a bit as we are still left in the dark phase as to the question whether we will see Brexit and if so when and in what shape. The answers to these questions will determine the fate of the British currency.

That means for GBP investors that the uncertainty continues. Until one of these scenarios has emerged as the main one, it remains unclear in which direction Sterling exchange rates will move longer term. At present, we therefore principally forecast a sideways move in EURGBP. However, that disguises the considerable risks into both directions.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -60 (which is bearish), GBP is at 164 (highly bullish) while articulating at (10:18 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One