RBNZ is scheduled for their monetary policy next week, market pricing for Kiwis is 25bps of easing, with a terminal rate of 0.70%. NZDUSD is little edgy at around 0.64 levels though the pair seems to be volatile for today, but the potential to test 0.64 level is reduced. The Fed’s rate cut is also perceived as the major catalyst for NZD’s upside traction.

Kiwis in the medium term perspectives: Although the recent gains in NZDUSD could extend in the near terms, speculator positioning remains extremely short NZD as the RBNZ is expected to keep OCR rate at 0.75% in this monetary policy, NZ inflation and housing data has been firmer than expected, and meat and dairy prices have risen. In addition, the USD has softened. Hence, we uphold our bearish stances, targeting 0.62 area, as the global trade tensions persist and global growth weakens further.

OTC Updates and Hedging Strategies:

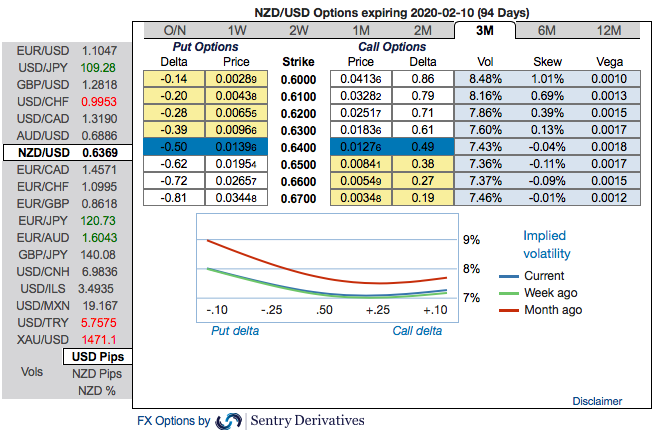

Let’s now quickly glance through OTC updates before deep diving into the strategic frameworks of NZDUSD. The pair is showing moderated IVs among G10 FX bloc (3m IVs are in between 7-8%).

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Most importantly, positively skewed 3m IVs indicate the downside risks.

Contemplating above fundamental factors and OTC outlook, diagonal debit put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

Alternatively, contemplating technical rationale also, at spot reference: 0.6363 levels, as we foresee major downtrend resumption may head towards up to 0.6050 levels amid mild buying sentiments, shorting futures of mid-month tenors have been advocated in our directional hedging strategy ahead of RBNZ with an objective of arresting puzzling swings.

As stated in our previous write-up, bulls have shown their effects upon the formations of dragonfly dojis.

The interim rallies are foreseen to be extended maximum up to 0.6437-50 levels in short run, we advocate initiating longs in NZDUSD futures contracts of November’19 delivery as further upside risks are foreseen and simultaneously, shorts in futures of December’19 delivery are the most important for the major downtrend.

Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately. Courtesy: Sentry & Westpac

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different