Over the weekend, the price of precious yellow metal has taken a halt from the vigorous rallies at the peaks of $1,738 levels. Gold, for the first time ever, punched through the R1m a kilogram price level. Though trading below its 2012 peak of $1,772.25 an ounce in dollar terms, the stiff resistance is observed at $1,750 areas. Gold (in the bullion market) gains considerably from the last couple of days, especially after gold testing the strong support at $1,445 - $1,455 levels).

Since March 19 when the front-end gold vols peaked the normalization has flattened the vol curve and halved the March vol spike. The fundamental analysts see gold price staying on a relatively muted glide path, modestly lifted by real yields only but starved of more explosive drivers. Amid such a backdrop, we reiterate from our previous posts that realized vol should be contained but the risk posed by daily spot gyrations even absent a drift keeps us more interested in fwd vols as a safer place to position for further normalization.

We feel cautiously optimistic that the worst is behind us as the gamma trade timing framework that were suggested in our recent posts, takes a U-turn from being the most defensive in the decade to being neutral. While the level of uncertainty about the overall economic impact and the path forward remains high the more upbeat sentiment amid an improved COVID-19 backdrop is continuing to put downside pressure on the gold vol curve. In this write-up, we emphasize the area for exploiting the precious metals backdrop.

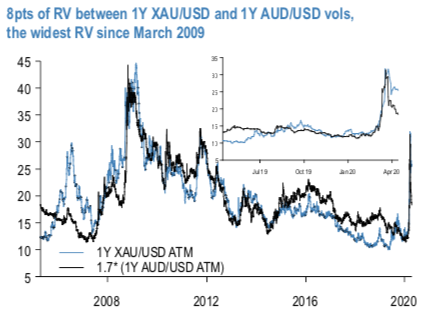

Well, AUD retraced 75% of the March spike gold vol has materially lagged completing only about 30% of the retracement. Accounting for the difference in the vol beta and correspondingly scaling up AUD vols (e.g. for 1Y tenor by 1.7X) results in nearly identical Feb-March vol spike (1-yr chart in the above chart).

That indicates AUD vols to have been an effective hedge during the recent vol episode. Even accounting for b/o the current XAUUSD – 1.7*AUDUSD vol spread of 7-vol pts and risk/reward of > 2X make the RV attractive for participating in a continued normalization. One risk is that the disparity in pace of normalization between gold and AUD vols could persist and keep the spread elevated.

Historically, narrowing of the spread tended to occur rapidly and in fairly monotonic fashion once normalization took hold in gold vols, the vol backdrop that we see now. 1Y tenor is a sweet spot both on gold and AUD vol curve and appeals as largely insulated from gold spot gyrations that would plague front tenors.

We recommend: Short 1Y XAUUSD delta-hedged straddles @24.25/25.5vols indicative hedged with long 1Y AUDUSD delta-hedged straddles @10.5/11.1vols indicative, in 1:1.7 notionals. Courtesy: JPM

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data