Turkey's central bank pulled forward a scheduled MPC meeting by two days and implemented a 100bps emergency rate cut yesterday. The CB reduced the 1-week repo rate from 10.75% to 9.75% and lowered RRR on all FX deposits by 500bps (for banks which are meeting loan growth criteria); CBT will also provide liquidity to banks using special intraday and overnight facilities as well as 91-day repos if necessary. CBT has increased the liquidity limit on primary dealers, which means that it will effectively fund them at 8.25% instead of the 9.75% policy rate. Having witnessed similar packages launched in recent days by major world central banks as well as several emerging market central banks, NBP for example, CBT's measures fall within a 'reasonable spectrum'. Such measures are being used to mitigate the worst side-effects of the coronavirus outbreak; they are, of course, not intended to solve the underlying healthcare problem, just dampen the collateral damage to the economy. Turkish GDP growth and inflation will both fall in coming months; at this time, the usual consideration of above-target inflation warranting higher interest rates is temporarily on hold. Rate cuts are more likely to have a positive impact on the currency because, without monetary easing, the economy would contract even more. This is why the lira outperformed peers notably following the announcement.

Since the latest data tell us that longstanding Turkish risks still persist, and meanwhile the real interest rate is going to negative, we should look for a sharp rise in USDTRY in coming months.

Hedging Strategy:

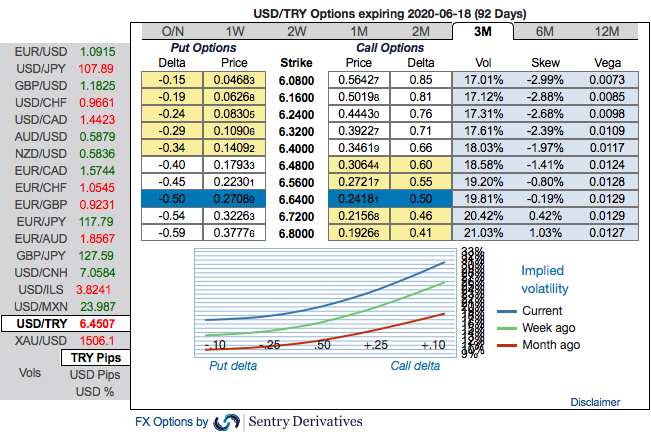

On hedging grounds, capitalizing on prevailing price dips and above driving forces, we already advocated 2m USDTRY debit call spreads with a view to arresting momentary downside risks and upside risks in the major trend. At spot reference: 6.4511 level, initiated 2m 6.05/6.80 call spreads at net debit. One can achieve hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

It seems that hedgers of TRY are positioned for the upside risks on the above fundamental factors. The skewness in 3m IVs are still indicating upside risks, higher bids for OTM calls are hedging bias towards upside risks (refer above nutshell).

IVs of this underlying pair is also on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is conducive for the option holder, just for an intuition that the higher likelihood of the market ‘swinging’ in holder’s favour. Courtesy: Sentry & Commerzbank

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios