In addition to the package of measures announced at last week’s unscheduled policy meeting, the Bank of England’s Monetary Policy Committee has sanctioned further easing measures at an emergency meeting. These included:

- A further reduction in UK Bank Rate, this time by 15bp taking it to an all-time low of 0.1% - the Bank of England’s view of the effective lower bound.

- A resumption of its QE programme where a further £200bn of assets will be purchased, financed by the issuance of central bank reserves. This will take the size of the Asset Purchase Fund up to £645bn and will primarily comprise of purchases of UK government bonds, with some non-financial investment grade corporate bonds also to be bought.

- An enlargement of the recently announced SME Term Funding Scheme (TFSME).

Given that the Bank of England announced a ‘big package’ of measures at its emergency meeting last week and was likely in the midst of its regular policy update timetable – that was due to end on the 25th March with an announcement on the 26th – the big question is why now? Based on the accompanying statement, the main reason is attributed to the recent deterioration in gilt market conditions.

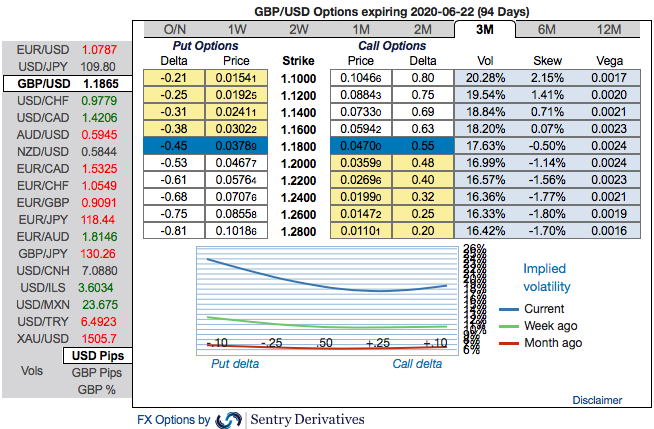

OTC updates: GBP will likely take its directional cue from the read-through to BoE’s rate cut whereas the size of the move will be augmented or moderated by the government’s broader policy platform, this is factored-in GBP’s FX options market.

Please observe 3m GBP skews that has stretched towards negative territory, hedgers have shown interests for bearish risks as you could see more bids on OTM Put strikes.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run. Accordingly, we advocate the diagonal options strategy on both hedging and trading grounds.

Though the underlying spot FX is showing some resistance to the prevailing bearish streaks, these rallies seem to be momentary. Hence, this is right time to write deep OTM put options.

Strategy (Debit Put Spread): Capitalizing on the above factors, it is prudent to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/2W GBPUSD put spread (1.15/1.28), spot reference: 1.1870 level. Courtesy: Sentry, Saxo & Lloydsbank

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty