We stay OW EM FX. In EMEA EM, we hold long RUB & TRY v. short ZAR, In EM Asia, we hold OW MYR and short USDSGD. G10 vols fell and EM vols rose during this week’s dollar shakeout, but decoupling is unlikely to sustain. Asian FX (INR, IDR, and KRW) vols are most susceptible to mean-reversion lower in EM, while GBP-vols look cheap in G10.

But in this write-up, we emphasize a quantitative and graphical representation of the volatility market among the EMFX space. We run you through in qualitative directional views for three currency pairs. Directional views in vol space.

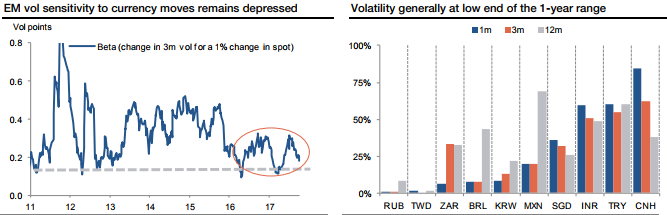

Despite the recent EMFX weakness, implied vol remains at the low end of its one-year range, while the gap between implied and realized vols is at the upper end of the range.

Vol and skew beta: The sensitivity of average EM implied vol and risk reversals to changes in underlying spot rates remains depressed.

Value: Based on the position of volatility to its one-year range and carry costs, volatility is particularly cheap in the RUB but expensive in INR.

KRW: Absent a severe escalation in tension or a worst-case scenario unfolding, volatility should be contained, the year-to-date range (1109/1161) should hold, and, as such, fading the risk premium in limited loss structures such as DNT is appealing.

INR: We’ve already advocated shorts on this pair in our recent post, fading the recent depreciation and selling volatility in a limited loss structure (if bond outflows reverse it could be very negative) is preferred over outright short USDINR NDF. We recommend a USDINR 3m put strike 65 with a knock-out at 63.5.

TRY: Vol, skew, and convexity are not expensive versus recent history. Investors that are concerned that the diplomatic row coupled with deterioration in fundamentals could spark a large depreciation/spike in volatility, could consider a USDTRY 3m one touch knock-in 4.35. Courtesy: SG

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings