Gold prices continued to trend higher this week (spot prices up 1.86% WoW basis so far, currently trading at $1,808.184/oz) as US real yields drifted lower, with the 10-yr real yield briefly dipping below -70bp late last week and 3.45% for the day. While we highlighted how increasing inflation expectations were the driving force pressuring real yields lower couple days ago, the primary catalyst shifted to falling nominal yields last week. 10-yr US nominal yields decreased 5bp last week as the daily growth rate of new COVID-19 cases, particularly in the three most populous states (California, Texas, and Florida), continued to rise. Nonetheless, inflation expectations also continued to firm last week (10-yr breakevens up nearly 3bp) meaning movements in both rates and inflation benefitted gold. For gold’s part it has so far maintained a pretty steady premium vs 10-yr real yields ($95/oz on average) over the bullish trend of the last few weeks. Looking ahead, our rates strategists believe the risks are skewed towards a further decline in nominal yields over the coming days, as rebalancing and technicals could drive yields lower. They have also flagged that near-term risks also appear skewed to the downside for breakevens as well. While this reversal in inflation expectations would offset some of the bullishness for bullion, so far 10-yr breakevens continued to remain firm in the face of rising US COVID cases last week.

The precious metal price has shown the upward movement as expected in our recent post. We are still inclined for calling for spot gold prices is most likely to prolong bullish price action over the next few weeks, peaking out between $1,850/oz to $1,900/oz on a spot basis.

OTC Bullion Market outlook:

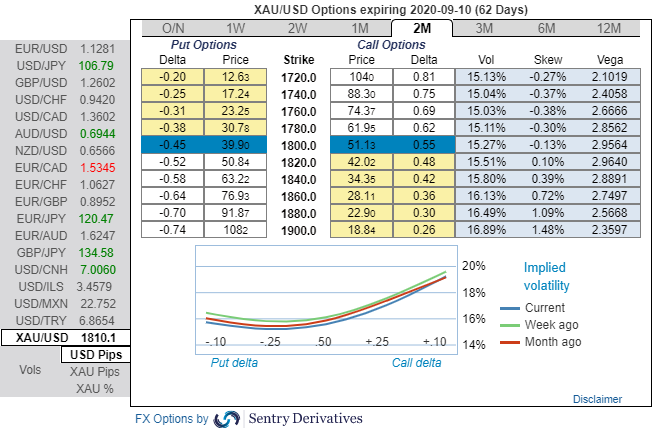

Gold front month ATM vol ended in the recent past where it started, at around 16 vols, currently trading at around 14.78%. We refer to JP Morgan’s Machine Learning based 1M ATM vol model that has been showing a moderate sell vol signal for the past week so we are leaning towards selling short term near the money vol.

Please be noted that 1m skews of gold’s ATM contracts are stretched on either side (hedgers foresee both upside and downside risks), while 3m skews coupled with the bullish neutral risk reversals indicate upside risks as you can observe the bids for OTM call strikes upto 1925 levels.

Hence, we also expect the extremely strong positive gold spot momentum to continue and accordingly, on hedging grounds, we advocate shorting 3M ATM puts for 16 vols and buying 3M 25D calls for 17 vols with an equal notional, indicatively. Courtesy: Sentry, JPM, & Saxo

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data