The JPY exposure has foundered on the combination of higher US bond yields which JGB’s have been unable to follow courtesy of the BoJ’s cap and lower US election risk.

The rather weak US data of the last few days cautions that the bond bears may not have it all their own way, but we are nevertheless neutralizing our option based JPY exposure to stem any further losses.

Maintain a near month at the money -0.49 delta put in CADJPY. Indicative offer 22.5%, unwind at 2.46%.

Close a 1m 99.0 USD put/JPY call, long a 3m 96.0 USD put/ JPY call. Paid 38.7bp on September 23. Closed at 29.6bp.

We’re neutralizing shorts in USDJPY given the move in bond spreads amplified by the BoJ’s JGB cap and now recommend fading the US election risk premium in CAD, taking losses on a bearish CADJPY option in favour of long CAD exposure versus GBP, also in option form with a correlation bent (a 2-mo at-expiry dual digital in GBPUSD lower, USDCAD lower).

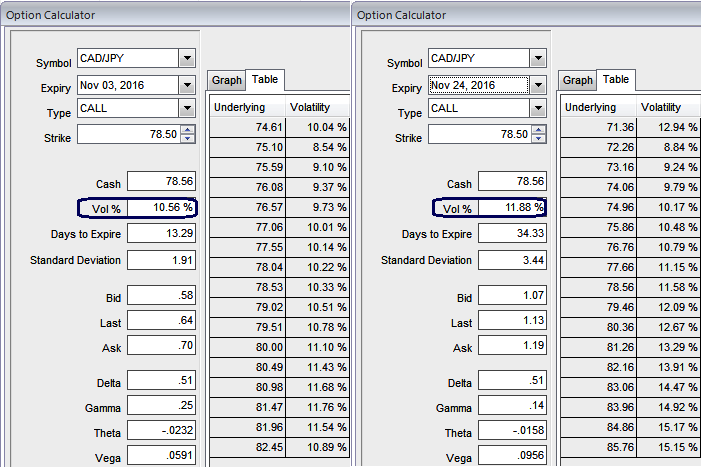

The implied volatility of 2w ATM CADJPY contracts is spiking higher at shy above 10.50%, and at 11.88% in 1M tenors.

Those who want to play it safe in option trading but keep downside risk on the check, use below option trading strategy that spreads the cushion for upside risks as well.

Keeping both IV and trend factors in mind, it is advisable to go long in 1M ATM -0.49 delta put while writing 1W (1%) ITM put with positive theta and delta closer to zero (both sides use European style options).

Margin: Yes for ITM shorts.

Risk/Return Profile: The return is limited by ITM shorts. No matter how far the market moves above that point, the profit would be the maximum to the extent of initial premiums received.

Thereafter, if the underlying spot price keeps dipping below the strike price of the lower strike put at the short expiration date, then the bull put spread strategy suffers a maximum loss.

This credit put spread option trading strategy is recommended when the spot FX is anticipated to inch higher moderately in the near term and not prolonged in long term but continue with long term downtrend.

Trade expects that the underlying spot FX of CADJPY would drop to ITM strikes on expiration and thereafter drop back again.

Thereby, you are speculating the CADJPY's struggle in short run by shorting, and hedge any dramatic downside risks in long term via longs in ATM strikes which is why we advise to use narrow expiries.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data