GBPAUD major trend has been bearish.

Short term bullish trend struggling for the momentum.

In the prevailing puzzled environment, you could observe that the momentary bulls of GBPAUD struggle to break and sustain above stiff resistance of 1.64 levels, currently trading in non-directly to signal some bearish pressures. We advocate below hedging strategy with cost effectiveness that could hedge regardless of the swings on either side.

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

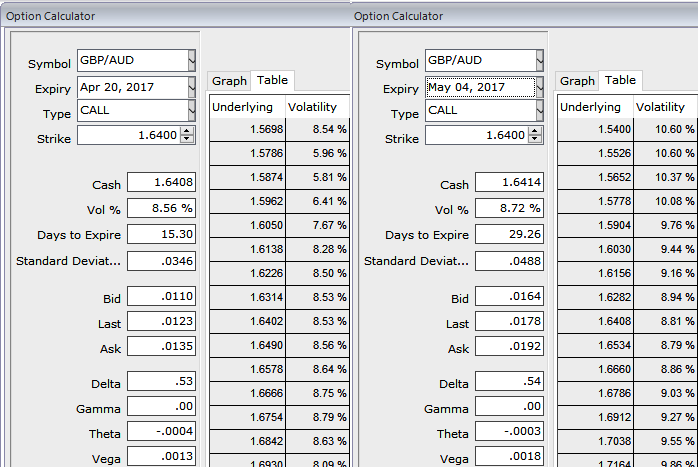

The execution: Initiate long in GBPAUD 1M at the money vega put, long 1M at the money vega call and simultaneously, Short theta in 2w (1%) out of the money call with positive theta or closer to zero. Theta is positive; time decay is bad for a buyer, but good for an option writer.

Rationale: As you could observe the vega of the long leg (buy) call option position is 113.51 USD and it implies that if IV increases or decreases by 1%, the option’s premium would have an impact in the increase or decrease by 113.51 USD, respectively. The Vega of a short (sell) option position is negative and an increasing IV is bad.

Please be noted that the 2w (1%) OTM calls are trading 39% more than NPV, while ATM implied volatility is trading at just shy above 8.5%, hence, amid struggling uptrend scenario we could see the disparity between IVs and pricing.

Hence, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025