There is a general consensus that the Swiss franc is highly overvalued, but the external balance remains strong. Both the SNB and IMF think so, and the Big Mac index lists the franc as the most overvalued currency in its sample.

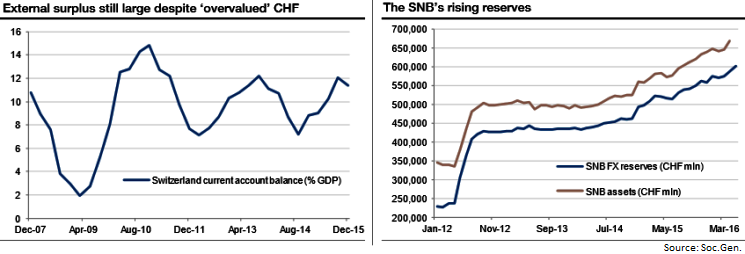

Yet, the Swiss current account balance still enjoys a substantial surplus at 11% of GDP and has moved higher since the EUR/CHF floor was abandoned in January 2015 (see above graph). Swiss exports have risen strongly over the past year after a brief drop in early 2015.

The SNB balance sheet expansion is accelerating. The growing reserves (and balance sheet) were widely cited as a key factor behind the decision to jettison the EUR/CHF floor policy. However, Swiss FX reserves have climbed at a faster pace in the 17 months since December 2014 than in the preceding period and are now the third largest in the world (see above graph). Consequently, the SNB remains bedeviled by a burgeoning balance sheet, with assets now (slightly) larger than annual GDP.

The SNB needs to recycle the external surplus, which will contribute to CHF depreciation. It is morphing into a sovereign wealth fund with an increased allocation of 20% into equities announced in Q1 16. The diversification away from EUR-denominated bond holdings is not just prudent but necessary given the sharply climbing reserves.

The SNB’s negative rate policy and foreign asset purchases are expected to drive the franc weaker gradually, but it is important to stress the word “gradually”. On the other hand, uncertain economic and market conditions ahead are likely to support CHF as a traditional safe haven, especially during incidences of global financial volatility.

The pattern of franc weakness ahead is thus likely to be of the ‘three steps forward, two steps back’ variety. Franc depreciation has helped lessen deflationary conditions in Switzerland, but the threat persists.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons