In the recent unanimous decision of South African central bank (SARB), benchmark rate is unchanged at 7% as had universally been projected. However, the SARB increased its projections and now only expects the overall rate to return into its target corridor of 3% to 6% by late 2017 (previously Q2 2017).

In addition to the higher oil price, this is mainly due to the strong rise in food prices as a result of the drought, that is taking longer to return to normal than expected.

The SARB now expects an average of 6.2% for 2017, following previously 5.8% while it still expects 5.5% for 2018. It has only lowered the growth forecast for 2017 marginally to the downside to now the moderate growth of 1.1% for 2017 (previously 1.2%) and 1.6% for 2018. The SARB seemed worried about the deteriorating short-term inflation outlook as well as about the fact that based on its calculations inflation will remain too close to the upper end of its target range even longer term.

However, it once again stressed its willingness to raise interest rates further should second round effects emerge. USDZAR eased further yesterday. Let us point out at this juncture that the rand remains susceptible. South Africa is still at risk of being downgraded to junk status, if the rating agencies consider the progress made with the reform efforts and stabilizing of the budget to be insufficient.

While the changed political landscape suggests the medium-term picture is shifting more positive, we remain tactically bearish ZAR.

Subsequently, on the option trade front among EMFX, we recommend positioning longs in USDZAR as the South African significantly overshooting fundamentals –

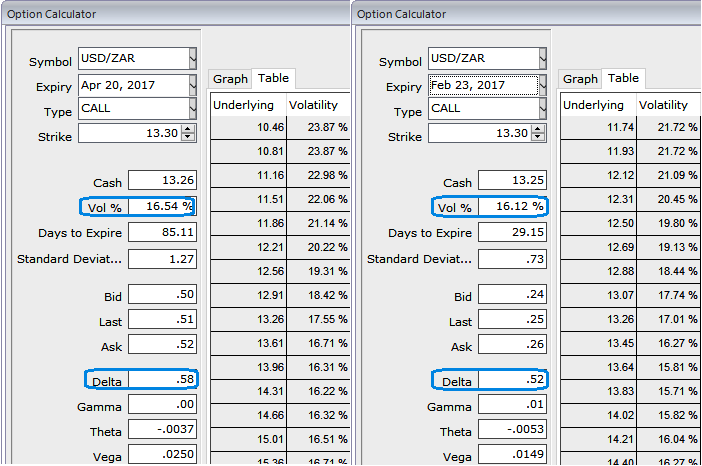

Please note that 1-3m IVs are conducive for call spreads, thus, advocating longs in USDZAR portfolios that make us buying USD vols all the more appealing. Instead of naked vanilla call form, we suggest call spread structure for the 2M horizon, optimizing strikes for leverage.

In USDZAR, the 1M-2M ATM spread is below average at +0.75, as 1M vols had remained relatively anchored and never softened significantly.

Therefore, the premium for owning US elections risk isn't punitive, and the short leg further mitigates the cost of gamma.

The above table explains how does the call spread is ordered in decreasing values of max payout/cost.

We find that skews aren’t steep enough vs ATM to allow for a wide range of strikes to be efficient. In order to ensure more than 50% discount to the outright vanilla, and a max payout/cost higher than 3.5:1, one needs to choose a combination of long 40D vs 25D.

The call spread achieves a 55% discount to outright call and a max payout/cost ratio of 3.7:1 (mid values).

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms