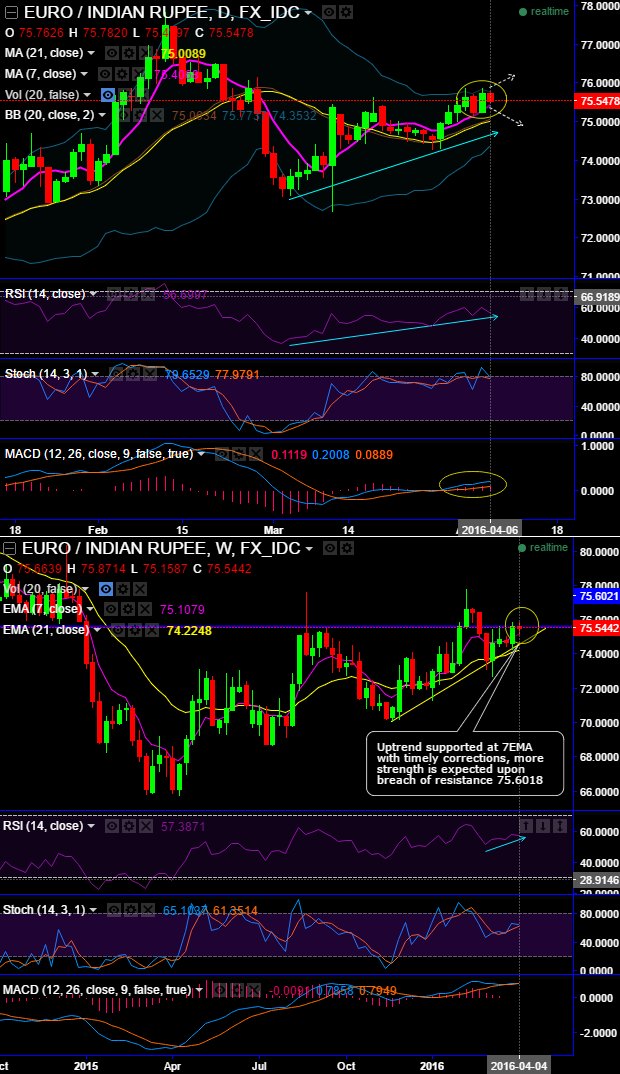

EUR/INR creeps up to reach 6-week's highs of 75.6770 levels after testing supports at 7DMA but could not manage to hold onto the day highs of 75.7820 as it reaches upper Bollinger band.

Current prices are well above 7 & 21DMA that indicates uptrend seems to be continued.

So, go long along with upper Bollinger band at supports near 7DMA.

While, daily RSI and Stochastic are suggestive of continued buying momentum. MACD signals bullish trend continuation. We wouldn't be surprised if the pair bounces back to 76.11 levels in near terms.

We see EURINR (270416) contracts on NSE (National Stock Exchange) at 75.7775 has the highest open interest.

So it is advisable to go long in near month futures but stay short in mid month futures, unlike forex options, where contracts are traded over OTC via currency brokers, currency futures are traded on exchanges that provide regulation in terms of centralized pricing and clearing.