We remain bearish on NZDUSD, forecasting 0.62 at Jun-20. We highlighted last month that, after initially leading the easing pack, NZD had begun to drift higher reflecting a convergence of dovish policy stances (particularly with respect to the Fed and RBA).

This didn’t end up lasting long, with the RBNZ racing back to the front of the pack with a 50bp cut this month, despite economist expectations and market pricing looking for only a 25bp move. We continue to think the RBNZ will be sensitive to global developments, and wary of any tightening of financial conditions that may come from failure to maintain negative rate differentials. With the central bank actively policing short-term rate spreads, we remain comfortable with a slightly negative bias on NZD.

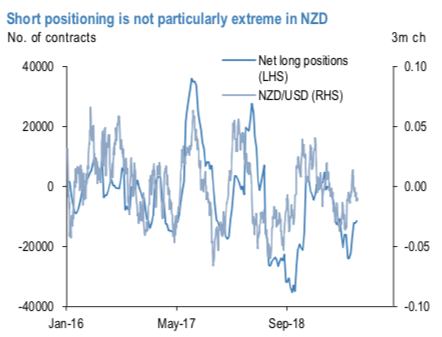

Positioning in NZD is somewhat short, though far from extreme, and the exchange rate has already out-performed somewhat relative to recent positioning shifts (Refer 1st Chart), which should limit vulnerability to a squeeze. The same picture emerges from the composition of the IMM data, which shows shorts recently accruing to real money/asset managers, facilitated in part by covering of leveraged investors (Refer 2nd Chart).

The main challenge to further downside in NZDUSD in the very near-term is the lack of domestic event catalysts. The data suggest a shortfall relative to the central bank’s targets that is chronic rather than acute.

Growth is a little below the 3% required to hit the inflation target, but not dramatically so, and the unemployment rate just hit a decade low (Refer 3rd Chart). There was no glaring economic need for such urgent action by the RBNZ, and the Governor’s guidance suggested that acting in a front-footed fashion should reduce the need for deeper cuts later. In our view, this takes away some risk of a follow-up move in September. We expect another 25bp cut in November.

Most importantly, 3m IV skews are right indications for NZD weakness that have clearly been in sync with the above fundamental factors to signal bearish risks. Hence, the major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

These positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.61 levels (refer above nutshell evidencing IV skews). Courtesy: & Sentrix & JPM

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed