As expected, the European central bank (ECB) left all benchmark interest rates on hold following the latest Council meeting, with the main refi rate remaining at 0.0% and the deposit rate at -0.40%. According to the statement, the ECB continues to expect that interest rates will be held at present levels or lower for an extended period of time and well past the horizon of net asset purchases.

President Draghi stated that risks to the region’s economic outlook are now less pronounced and the main message was that overall downside risks had eased. Draghi was more optimistic surrounding growth, but there were still doubts whether this would translate into higher inflation.

The conclusion of last week’s Governing Council meeting inevitably saw no change to current ECB policy in terms of interest rates and the asset purchase programme. However, perhaps somewhat more unexpected, there was no substantive change to the ECB's forward guidance, with policymakers giving no hint whatsoever that the rate of asset purchases might possibly be slowed further this year beyond the drop to €60bn from April already announced, and reiterating their willingness to increase the programme in terms of size and/or duration if necessary.

Option Trades:

Buy 6M EURUSD ATM and 6M USDJPY ATM vs. sell 6M EURJPY ATM in 60:100:-150 vega ratios.

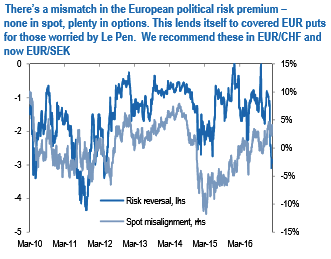

EURUSD 3M 25D risk-reversal versus the misalignment of EURUSD spot rate defined as the residual from a 7Y regression of spot on 2Y rate spreads, balance sheets and sovereign spread.

Sell EURUSD 3M ATM vs Buy EURUSD 6M ATM.

Buy ATM 2M EURUSD vs. sell 2M EURSEK, in 100:140 vega ratio.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?