RBNZ monetary policy is scheduled on 23rd March where OCR would be decided.

We expect NZD to fall through this year, reaching 0.63 against the USD and below 72.620 level at year-end, falling real rates and tightening credit keep us bearish.

The support to growth from migration will fade, while the RBNZ –at the very least–is likely to hold rates steady as inflation normalizes, pushing real rates materially lower.

The economy is also now subject to credit tightening through numerous channels: macro-prudential constraints, regulatory initiatives, widening mortgage rate spreads, and banks’ discretionary tightening of credit criteria to businesses.

We now expect the RBNZ to be on hold this year, but there is a clear downside risk to the OCR over the course of the year.

OTC updates and hedging framework:

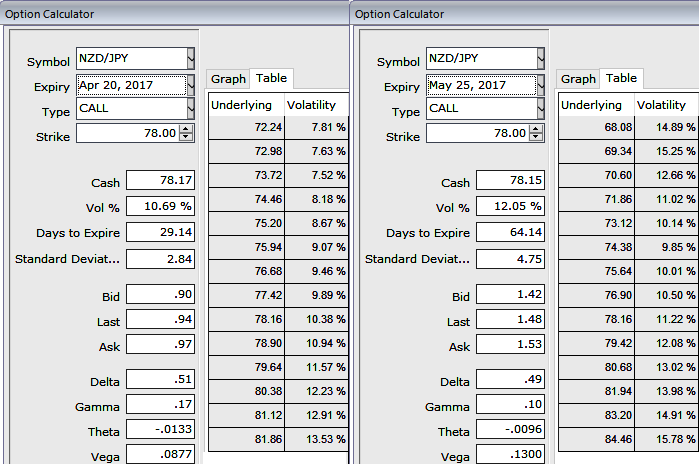

Please be noted that the 1m IVs are trading at around 10.69%, while 2m IVs are at around 12.05%. The 2-month IVs are to encompass major data events. Despite the fact that the significant data events are lined up, lower 1m IV is good news for option writers.

In NZDJPY, if you're a skeptic on any abrupt rallies, then the upside potential is restrained at 80.650 (as stated in our technical write up, bearish WMA crossover is most likely) and to keep price declines on check then the below strategy is advisable. Visit our below weblink for more reading on technicals of this pair:

Well, we expect NZD to fall through this year, with upside cap max at 84.381 against JPY and even upto 69.313 at year-end.

1m ATM call option is trading 13.8% more than NPV, where IVs are just shy above 10.5%. hence, we see shorting opportunities in such exorbitantly priced calls.

Ideally, the below option trading strategy is constructed for those who have exposures in spot FX of this underlying pair while, simultaneously, buying a protective put and shorting calls against that holding.

The strategy goes this way: while you're holding longs in spot FX of NZDJPY, go short in 1m (1.5%) OTM striking call and long in 2m (1%) OTM striking put. Since the short term, bullish sentiments are mounting we kept upside bracket little on the higher side.

On the flip side, when you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Use above mentioned IVs (1m2m) for both short and long legs respectively. This strategy is the best suitable if you're writing covered calls to earn premiums but wish to protect himself from an unexpected sharp drop in the price of the underlying spot FX.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence