FX vols underwent through a bi-modal pattern since late February, rising sharply until around March 20th and dropping almost as steadily since then. The rise was associated with the “shock” component linked to the most acute phase of the COVID-19 crisis. Current valuations appear to be benignly pricing the economic follow-up to the health crisis. VXY-G10 pricing is less than 3vol pts from the mid-February all-time low.

This hints that the structural forces that triggered a broad- based reduction of FX vols over the past five years might now be back into play. The comparison of the average USD/G10 3m market vol with two exogenous drivers, equity and rates volatility, suggests FX vol to be undervalued vs US Equities but finds FX vols rich vs rates by around 2 vols.

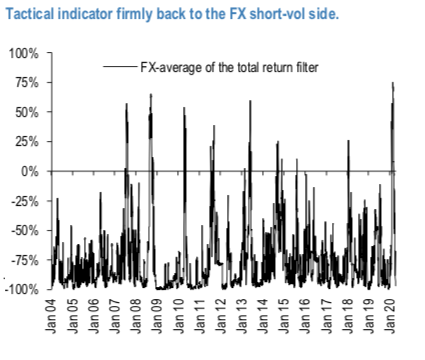

Indicative of the improved FX vol backdrop the tactical gamma trading indicator that relies on a slew of global risk sentiment indicators and currency specific vol surface indicators is firmly back into the FX short-vol territory (refer 1st chart). Consequently defensive vol positions find themselves in a hot seat but amid the political noise level rather than scrapping them we suggest a few risk premium harvesting strategies to alleviate the bleed.

As ATM vols are still sluggish (refer 2nd chart), tactical gamma indicator is firmly back into the FX short vol territory. Defensive vol positions are clearly feeling it. Rather than scrapping them we suggest alleviating the pain by adding risk harvesting legs. Courtesy: JPM

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts