As we described in the Outlook, EUR maintains a number of structural supports, including its status as a BoP surplus economy and its overall cheap valuation. We’ve designed our shorts to neutralize each of these. On the former, any benefit to EUR from its net lending status as the global backdrop continues to deteriorate should be more than offset by a similar dynamic for CHF, which has the strongest BoP position in G10 (CA +10%). JPY shares similar, if less robust, surplus status.

And on valuation, EUR may be due for some mean reversion but not more so than JPY, which screens inordinately cheap especially in relation to the current stage of the business cycle. We would expect the latter to significantly outperform as a result should the macro backdrop worsen considerably. By neutralizing two of these underlying pillars, the hurdle for our trades to underperform remains a material turnaround in the European growth narrative.

As described above, there seems to be no inflexion point insight; JPM economists have again revised down our expectations of German growth (now into contractionary territory for 2Q), underscoring that growth in the region cannot even manage to plateau, let alone improve.

Finally, while EUR may receive bouts of support from Pres. Trump’s increasing vociferousness on currencies and monetary policy, that will also preclude any CHF weakening from SNB intervention, which balances our risks there as well.

Stay short EURJPY in cash. Marked at 0.79%.

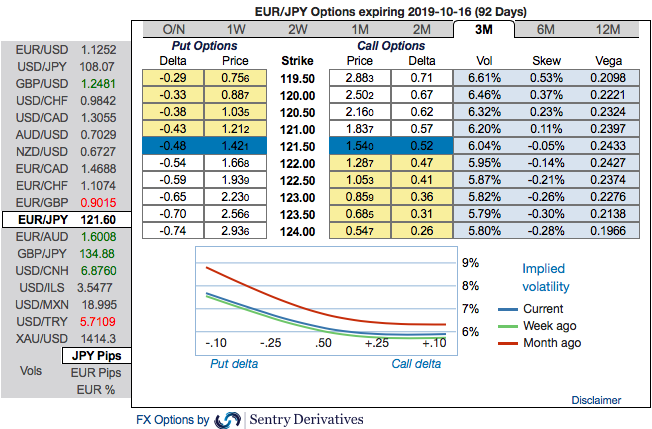

Please be noted that the positively skewed IVs of 3m EURJPY contracts that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 119.00 levels so that OTM instruments would expire in-the-money.

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Hence, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Alternatively, ahead of ECB monetary policy meeting, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. We now wish to roll over these contracts for August month deliveries. Source: Sentrix and Saxobank

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes