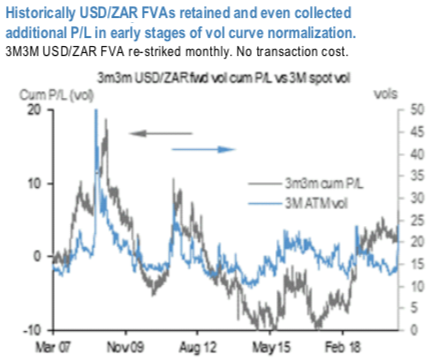

FX vol curves, despite the recent retracement, remain still heavily inverted, offering a value in owning fwd vol at a discount vs. spot vol.

Last week, we noted USDMXN and USDRUB as two notable candidates in fwd vol space.

While vol carry (measured as spot fwd vols difference) is traditionally the first metric to measure fwd vols appeal, we also bring into consideration the headroom that fwd vols have if they are to retrace their 15-year high.

Liquidity permitting, the EMEA fwd vols (USDPLN and USDHUF) and USDKRW within Asia EM screen attractively on that measure on the back of so far fairly modest response to the COVID-19 developments (especially within EMEA currency pairs).

Considering the strong lean toward long gamma from the timing model and favorable fwd vols pricing, we recommend synthetic fwd vols via short 3M / long 6M gamma neutral calendar in USDPLN and USDZAR (refer above chart).

The wide dislocations as observed in the market might also imply an elevated reward for embracing long-risk trades. Possibly, keeping in mind the liquidity issue in vol space as mentioned above, one takeaway from the filtering analysis would be to wait until market conditions stabilize before looking at fading any residual risk premia by then.

The wide dislocations as observed in the market might also imply an elevated reward for embracing long-risk trades. Possibly, keeping in mind the liquidity issue in vol space as mentioned above, one takeaway from the filtering analysis would be to wait until market conditions stabilize before looking at fading any residual risk premia by then.

March). This is particularly the case in the Asian space, where risk-reward for such trades is positively skewed, especially for cases like USDINR, EURINR and EURCNH.

Consider:

On USDZAR, sell a 3M straddle at 18.95 vols choice / buy a 6M straddle at 18.5 vols (1.25 vols from mid).

3M ATMF/ATMS put spread on USDINR at USD 1.5% (off spot reference: 75.3, fwd 77.88).

1y ATMF/ATMS put spread on EURCNH at EUR 1.4% (off spot reference: 7.8365, fwd 7.97). Courtesy: JPM

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand