Having been a choice expression for the dollar’s dominance over high-beta FX in 2018, the outlook for NZD is now more nuanced as other previously more hawkish central banks have abandoned hiking biases.

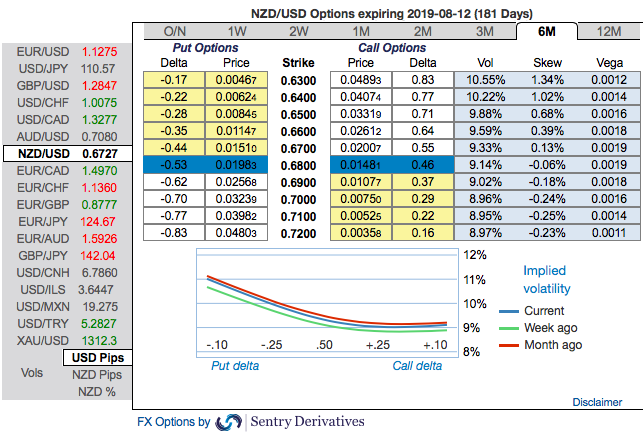

We raise our 2019 NZDUSD forecasts by 2-4c while preserving a downward slope. By end of 3Q’19, our forecast is towards 0.63 levels. Please be noted that FX options hedging activity of this pair is also in sync with the above projections. 6m IV skews have clearly been indicating bearish risks. Hence, major downtrend continuation shouldn’t be panicked the broad-based bearish outlook amid minor rallies.

These positively skewed IVs of 6m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.63 levels (refer above nutshells evidencing IV skews).

Dovish shifts in policy guidance from the Fed and RBA, which we did not anticipate, have removed the RBNZ’s status as the most dovish central bank in G10. The pullback in the US real rate outlook has also buoyed commodities generally, as captured in the J.P Morgan commodity curve index (refer above chart).

Even as the NZ data rebounded over the latter part of 2018, Governor Orr declared that the OCR will need to be on hold until 2020 in order to sustainably hit the inflation target.

Hence, for those who foresee the long-term exposures, ahead of RBNZ monetary policy that is scheduled for this week, contemplating above factors, we advocate initiating shorts in NZDUSD futures contracts of June’19 delivery as further downside risks are foreseen and simultaneously, longs in futures of Mar’19 delivery. Thereby, one can directionally position in their FX exposures. The directional implementation of the same trading theme by further allow for a correlation-induced discount in the options trading also if you choose strikes appropriately.

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 129 levels (which is neutral), while hourly NZD spot index was at 47 (bullish) while articulating (at 09:58 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady