In Canada, official data showed that manufacturing sales increased by 1.0% in April, beating expectations for an uptick of 0.6%, after a 0.9% fall the previous month.

On an expected stabilization then rebound in crude oil prices and better performance in the non-resource sector.

The benefits of a weaker CAD are expected to present a boost to growth via exports and there are signs that the most exchange rate sensitive sectors are already performing well.

The loonie lower against the euro, with EURCAD pairing 0.25% to 1.4458.

The commodity-driven CAD was also under stress amid declining crude price due to mounting concerns over a Britain's potential exit from the European Union and a surprise rise in U.S. inventories.

We look for the BoC to begin tightening monetary policy in Q3 & Q4 of 2016.

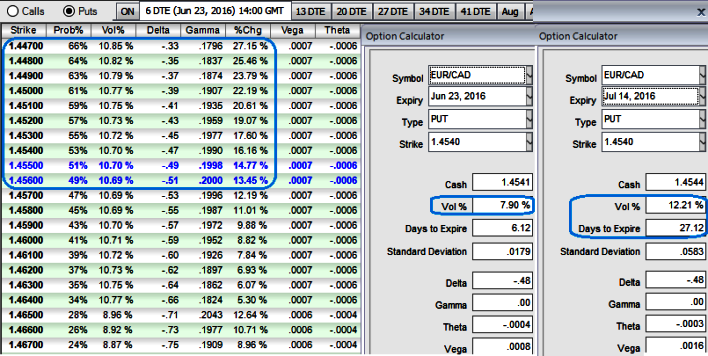

1w ATM IVs of EURCAD is tad below 8%, and likely to spike above 12% in 1m tenor.

A 2:1 put ratio spread can be implemented by buying a number of puts at a higher strike and selling twice the number of puts at a lower strike.

The put ratio spread is a neutral strategy in options trading that involves buying a number of puts and selling more put options of the same expiration date at a different strike price.

It is a limited profit, an unlimited risk options trading strategy that is taken when the options trader thinks that the underlying spot FX would experience little volatility in the near term.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate