Speaking of the BoJ as the Japanese central bank scheduled for its first monetary policy in 2018. The bank’s personnel change would rather be in emphasis in January and February as Governor Kuroda's term will expire in April and Deputy Governor Iwata and Nakaso will end their terms in March. While the consensus and we expect Kuroda to be reappointed as Governor, headlines related to possible candidates will possibly impact JPY.

If we hear names such as Takatoshi Ito (Professor of Columbia University) and Hiroshi Watanabe (ex-vice minister of Finance) as possible candidates, it could be taken as slightly bullish for JPY since they have suggested that the BoJ should start considering exit policy (while being generally in support of the current monetary policy). The personnel announcement will likely be made in February, and if Kuroda is reappointed, JPY might depreciate slightly but the impacts would be short-lived.

On the flip side, the final quarter of 2017 has indulged a significant institutional shift to New Zealand. Not only does New Zealand have a new government with a distinctive policy agenda, but change is also afoot at the RBNZ.

In December, the government announced that Adrian Orr would be the next Governor of the RBNZ (commencing 27 March 2018). We view this announcement as a modest positive for NZD, given that this appointment should also act to somewhat soothe foreign investor perceptions about the nature of the changes at the RBNZ after the election.

Orr's return delivers continuity through the transition to the dual mandate, and his organizational experience may make it easier for him to wrangle a monetary policy committee with external members, as will be required under the new decision-making structure.

RBNZ officials have ratcheted down their concern around the currency. In August, Governor Wheeler stated a lower NZD was “needed” to increase tradable inflation and achieve more balanced growth, while in November, the Governor noted that the exchange rate had “eased” since the August MPS and if sustained, “…will increase tradable inflation and promote more balanced growth.” The NZD TWI is only up marginally since the November MPS.

OTC Outlook and hedging strategies:

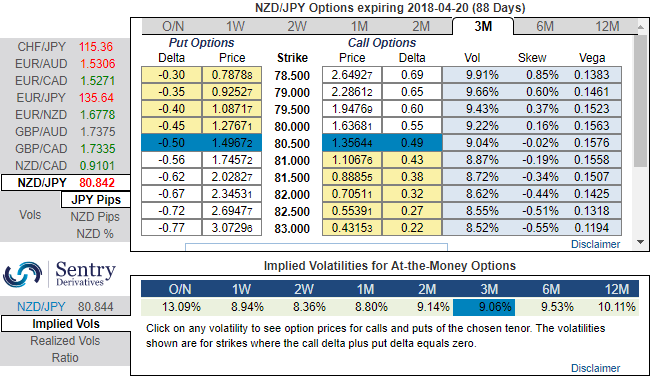

ATM IVs of NZDJPY is trading between 8.80% and 9.06% for 1m and 3m tenors respectively and positively skewed IVs of 3m tenors are evidencing bearish hedging interests. Bids for OTM puts upto 78.50 is noticeable to signify downside risks.

Accordingly, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.16. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OT strikes.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation