According to US President Donald Trump, not enough progress has so far been made with the Mexican delegation in the negotiations on stemming the flow of illegal immigrants and drug smuggling. The negotiations are to resume today. If no solution is found until Sun- day evening there is a risk of 5% tariffs being imposed on all imports from Mexico. That means short term timeframe will remain difficult for the peso. We urge caution even if the introduction of tariffs can probably be avoided in the very end.

Currently, the FX market lacks the impetus to trade the Mexican peso in one direction or the other.

External factors and domestic risks balance each other out. The external factors are providing a friendly environment for EM currencies. In particular, the prospect that the Fed is at the end of its rate hike cycle and may even cut rates next year supports EM currencies. However, due to economic and political risks, the Mexican peso can only benefit to a limited extent. Should sentiment become less favorable for EM currencies, which is quite possible due to global economic and trading risks, domestic risks should gain the upper hand and put the peso under downward pressure.

Weak growth, domestic political risks and growing concerns about the financial situation of the state-owned energy supplier and thus about a possible deterioration in public finances are likely to weigh on the peso in the coming months. But we do not expect an excessive depreciation as long as there is no external shock. Additionally, the negotiated USMCA deal should be ratified by the respective parliaments this year, which would remove a major uncertainty factor from last year.

Of late, MXN seemed to be extending recovery threatening upper bound of the recent range.

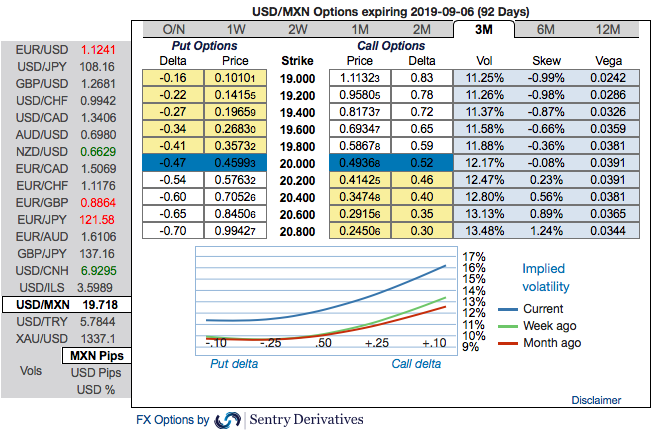

But please be noted that the 3m USDMXN implied volatility skews signal continued upside risks.

The previous massive sell-off of Mexican peso caused a vol surface dislocation, nudging skews to the highest since the 2016 US Presidential elections. Delta hedged 1*1.5 ratio call spreads exploit the dislocation while also having historically offered a superb performance. +1Y/-3M calendars of risk reversals take advantage of the lagging back-end vs front-end implied skews. Courtesy: Commerzbank, tradingview.com & Sentry

Currency Strength Index: FxWirePro's hourly USD spot index was at -144 (highly bearish) while articulating at (13:53 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data