The final eurozone consumer price inflation figures for June brought a small surprise: the headline rate unexpectedly came in at 1.3% yoy, compared to a flash estimate of 1.2%. But anyone who now assumes that this could shake the ECB's stance is definitely on the wrong track.

First, the increase is due to a revision of the German data, possibly due to a calculation error. Second, several ECB members have emphasized repeatedly that the Council focuses on the core rate, which is still hovering around 1% and unlikely to rise much in the coming months.

Moreover, the euro-area industry is still in a recession and the trade conflict is weighing on the growth outlook - just take a look at sentiment indicators, such as the disappointing ZEW index on Tuesday.

Yesterday, ECB Board member Benoît Coeuré underlined once again that risks to growth are tilted to the downside, that core inflation remains muted and that the ECB Council is "determined to act", if necessary. From our vantage point, there is no reason to doubt the ECB’s readiness to cut its key rate next week. And there is no reason for the euro to appreciate considerably in the short run.

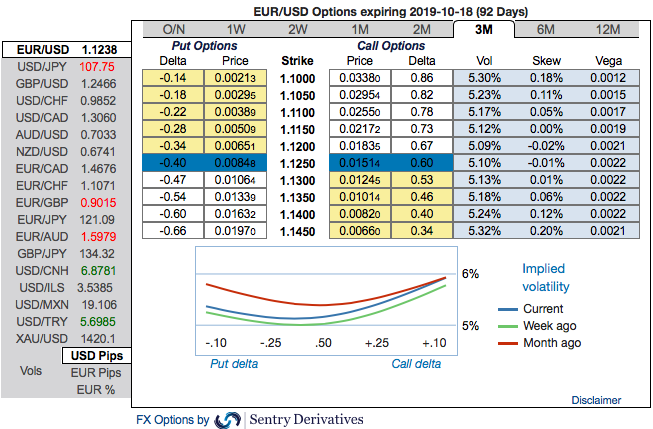

Most importantly, the FX OTC hedging markets are also suggesting the same thing, the IVs and risk reversals of the short tenors indicate interim rallies but the major bearish hedging sentiments remain intact.

Volatility traders perceptibly expect only about what is likely to and what actually turns out. As you could observe the above nutshell, 3m positively skewed IVs are stretched on either side (equal interest in both OTM call and OTM puts) that signifies hedging sentiments for both upside and downside risks.

To substantiate these indications, a positive shift in short-term and bearish neutral RRs (risk reversals) across long-term tenors, which is in line with the above-stated bearish scenarios.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing ITM put holders. Contemplating all these factors, we advocate below options strategy.

Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors, write a (1%) out of the money put option of 2w tenors.

Alternatively, the dubious bulls but with a hedging grounds, can also deploy 3m 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.Courtesy: Sentrix, Saxo & Commerzbank

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One