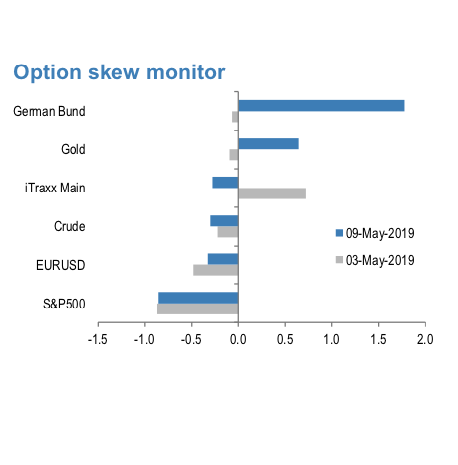

The skewness is the difference between the implied volatility of out-of-the-money (OTM) call options and put options. A positive skew implies more demand for calls than puts and negative skew, higher demand for puts than calls.

Hence, it can be seen as an indicator of risk perception in that a highly negative skew in equities is indicative of a bearish view.

Well, the above chart indicates z-score of the skew, i.e. the skew minus a rolling 2-year avg skew divided by a rolling two-year standard deviation of the skew.

A negative skew on iTraxx Main means investors favors buying protection, i.e. a short risk position. Hedgers of EURUSD and S&P500 are more keen on bearish risks, while German bund and Gold seeks the protection for the upside risks (refer 1st chart).

A positive skew for the Bund reflects a long duration view, also a short risk position.

Amid huge turbulence in GBPJPY moves, please be noted that IVs of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 135 levels (refer 2nd chart evidencing IV skews).

While the positively skewed IVs of GBPUSD is also indicating downside risks (refer 3rd chart) on Brexit uncertainties. Whereas skews in gold signal upside risks (4th chart) on FOMC minutes of the meeting in early May the debate amongst the members about weak inflation levels at the beginning of the year is relevant. Fed Chairman Jay Powell made every effort in the press conference after the meeting to convince everyone that this weakness was due to transitory effects. Courtesy: JPM & Sentrix

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 127 levels (which is highly bullish), USD is at 12 (mildly bullish) while articulating (at 12:12 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data