In the last few months, North Korea has increasingly become bolder with its actions. It fired missiles 3 times in May and once in June, followed by 2 ICBM (Hwasong-14) launches in July (4th and 28th), of which both landed in Japan’s Exclusive Economic Zone (EEZ) in the Sea of Japan. Furthermore, North Korea disclosed its plan to attack Guam with intermediate-range ballistic missile (IRBM) on Aug.9 and it successfully launched one, which landed in the Pacific Ocean, flying over Hokkaido on Aug.29. It has fired missiles 13 times so far this year.

Although the impacts on JPY of North Korea’s actions have been limited so far, if North Korea continues to push its boundary, we cannot exclude the possibility that JPY becomes more sensitive over its actions. As tomorrow (Sep. 9) is National Foundation Day of North Korea, we may see some escalated actions over the weekend/beginning of next week.

Amid the current heightened tensions, it is difficult for investors to keep JPY-short positions, which implies that JPY appreciation this time may not be short-lived unlike the past several months.

USDJPY will likely be supported around 108.13, this year’s low, unless we see a further escalation of military action of North Korea. Nevertheless, if the situation deteriorates, the possibility of USDJPY breaking and falling below108.13 is likely to increase.

Meanwhile, the decline in USDJPY this week was attributable to not only JPY strength but also USD weakness. Despite recent relevant development in US macro environment, expectation for Fed hikes has receded and now the FF future market does not even price in one hike by end-2018. This appears extreme and it will likely be reversed once concerns about North Korea mitigate. If the market starts pricing in more Fed hikes then, it would result in higher UST yields and a rebound in USD.

Thus, we are cautious about the risk of short-term plunge in USDJPY due to escalation of North Korean developments; however, we would see a quick and robust rebound of USDJPY once the concerns clearly recede. Leaving aside the near-term concerns over North Korea, we continue to expect a gradual downward trend in USDJPY mainly because of general USD weakness. FOMC today will unlikely become a catalyst for USDJPY moves since the pair remains strongly correlated with the Fed rate hike expectation. The BoJ is expected to keep monetary policy unchanged at upcoming monetary policy meeting tomorrow. It’s comfortably projected with year-end target of USDJPY at 107.

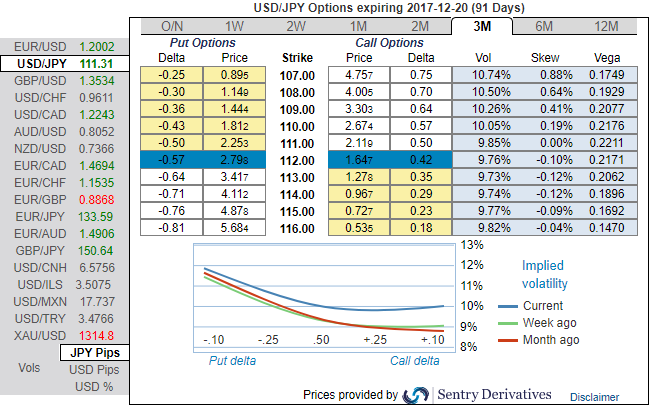

Please also be noted that the IV skewness are very conducive in determining this decision, here in case of USDJPY, one could easily make out positively skewed IVs are signifying the importance of OTM puts but not deep out of the money puts (3m skews are also suggesting strikes maximum upto 107). This bearish sentiment is in sync with the mounting negative risk reversals that again indicates further bearish risks.

If IV increases and you are holding an option, this is good. In contrast, if it goes in adverse direction, then one should raise a cause of concern for his option strategy.

A smart approach to tackle this obstacle and potentially profit from volatility is to create a delta neutral position on a security that you believe is likely to increase in volatility. The simplest way to do this is to buy at the money contracts or OTM strikes but certainly not deep OTM strikes.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated