The Kiwis trade balance for October was -$846m which is better than anticipated, with a stronger than projected export performance.

Seasonally adjusted imports increased by 2.1% MoM. The imports were cushioned by a one-off aircraft of $254m. If this is excluded, imports fell 2.1% MoM in October and the trend remains subdued. Households appear to be showing continued restraint outside of the odd new car purchase.

With the likes of consumption goods imports dropping by 5.3% YoY when consumption indicators (labor market strength, house price gains, high consumer confidence etc) look hot. Crude oil imports were softer in October too mainly due to a 19% MoM fall in volumes, suggesting some catch-up next month.

The import of capital and intermediate goods were both softer and combined with weaker exports to developed markets and the still high NZD TWI perhaps suggest some headwinds for small manufacturers. This is further supported by weaker mechanical and electrical machinery equipment exports in the month of October too.

In the medium term, the pair likely to head towards 1.0750 or above in 1-3 months’ timeframe. The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment.

The RBA expected to sit tight at a 1.5% cash rate for some time, while RBNZ’s any further easing bias slightly hard to justify. The RBNZ ended its easing cycle on 10 Nov and will now remain on hold for a long time.

OTC updates and Options Strategy:

As a result of the above economic and monetary policy events, the kiwi dollar was lower against the Australian dollar, with AUDNZD edging up at 1.0616, as all key resistance levels are broken, the further upside can’t be ruled out and it is likely to spike higher on account of the NZ central bank further easing cycle is forecasted.

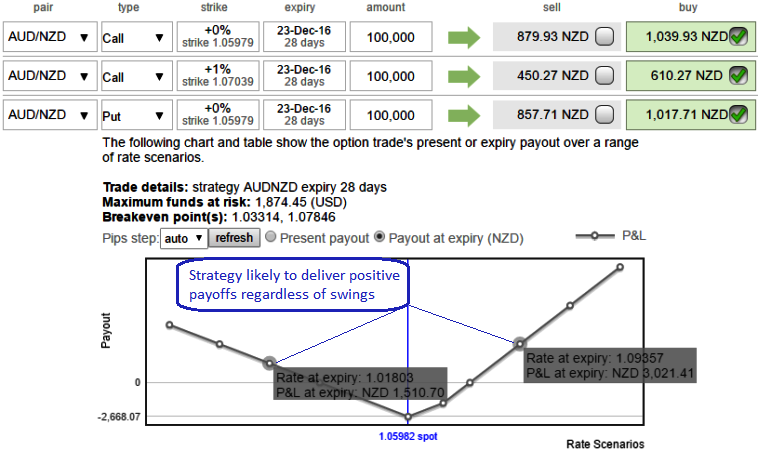

We had advocated the option strategy in order to keep AUDNZD’s appreciating risks on the check.

1m at the money implied volatilities of 50% delta calls and puts are trading at around 7-8% which is reasonable as the vols currently are working in the interest of option holders as you can see IVs and corresponding movements in vega.

Well, in order to arrest this upside risk and to bet even on abrupt dips, we recommend option strap strategy that favors underlying spot’s upside bias.

So, we recommend building the FX portfolio exposed to this pair with longs positions in 1 lot of 1m ATM 0.51 delta call, 1 lot of 1m (1%) OTM 0.36 delta call and 1 lot of ATM -0.49 delta puts of 2w tenor. We chose this strategy this so as to favor major non-directional trend and short-term bullish trend.

We encourage delta instruments here as the higher (absolute) delta value is desirable for an ATM option buyer when you are more aggressive about the direction of the underlying spot but gutsy to digest if it slightly forgoes against you, whilst a delta close to zero is desirable for the option seller; a buyer wants their option to become more valuable whilst a seller wants the option to become less valuable.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation