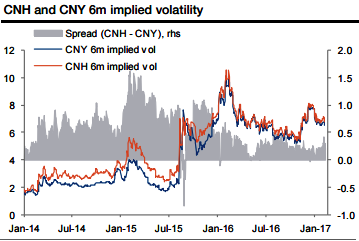

The options trades are preferable over forwards as the implied volatility is similar between CNH and CNY (CNH vol is 0.2 vol points higher than CNY vol in the 6m tenor) and the vol spread has been narrowing over time.

These conditions provide interesting option-based relative value strategies, where investors can enter zero cost structures (plus/minus a few basis points depending on spot, points, and vol) to position for the CNH-CNY basis flipping.

A notable advantage of the option strategy is that positioning for the basis to flip is contingent on RMB depreciation (topside strikes), whereas a position in forwards could underperform and has greater MTM risk if the RMB strengthens or is stable.

Our base-case scenario envisions USDCNY rising to 7.30 by the end of 2017. The structural richness of implied volatility over realized argues for short volatility structures. Additionally, short downside volatility is appealing because there are few fundamental reasons for the CNH to trade meaningfully stronger over the next year. Owning a 1yr USDCNH zero-cost seagull structures have consistently been advocated (6.90/7.20/7.50, zero cost) offers a maximum gain of 4.1%. With no digital risk involved and limited convexity, the position can be conveniently delta-hedged. Losses are unlimited if USDCNH trades below the 6.90 strike in one year.

The structure is a standard 1y call spread strikes 7.20/7.50 fully financed by selling a put strike 6.90, exposed to a maximum USDCNH appreciation of 4.1% at expiry.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?