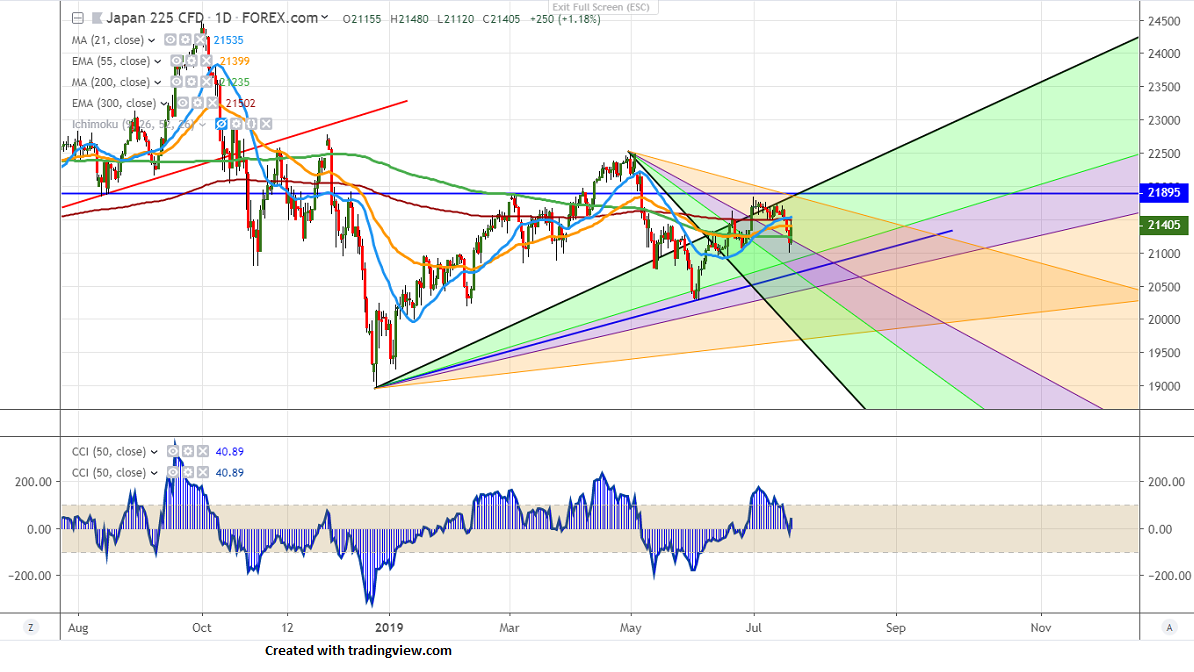

Major resistance- 21500 (300- day EMA)

Major support - 20700

Nikkei has shown a sharp recovery and jumped more than 400 points from low of 20992 on rate cut hopes. US 10 year yield has lost more than 6% from high of 2.15% US New York President Williams said on Thursday that the most effective strategy for the Fed is to cut rates at the first sign of trouble and this has increased hopes of 50 bpbs rate cut. The index is holding above 200-day MA and is currently trading around 21415.

US Market- The Wall Street is trading higher and closed with Dow Jones and S&P500 closed at 27223 (0.01%) and 2995 (0.36%).

Japanese Yen- USDJPY has recovered nearly 40 pips from low 107.21 but still trading below trend line resistance 109 and this shows the overall trend is still in bearish mode. Any break below 106.788 low made on Jun 25th 2019. It is currently trading around 107.66.

Shanghai composite- Shanghai is trading slightly higher after more than a 5% decline. It is currently trading around 2922. Any break above 2945 confirms bullish continuation and jump till 3000/3020 likely.

Technically Nikkei facing strong resistance around 21500 (300- day EMA) and any major jump can be seen only if it closes above this level. Any close above targets 21642 (61.8% fib)/21800.

On the flip side, near term support is around 21000 and any violation below this level will take the index till 20700/20500/20291 (Jun 2nd low).

It is good to buy on dips around 21200-225 with SL around 21000 for the TP of 21800.