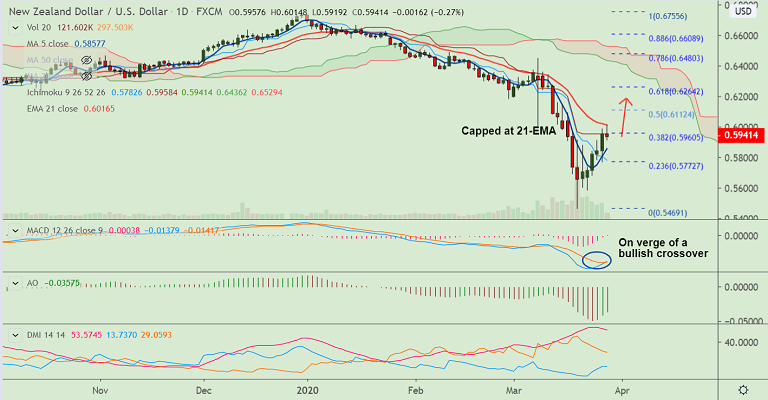

NZD/USD chart - Trading View

NZD/USD erases early gains, trades 0.26% lower on the day at 0.5941 at 08:45 GMT.

The pair has paused a 5 day winning streak as upside remains capped at 21-EMA resistance.

5-DMA has turned, MACD is on verge of bullish crossover on signal line and Stochs and RSI have rolled over from oversold levels.

Major trend in the pair is bearish. However, minor trend is turning slightly bullish, raising scope for upside.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) on the daily charts could limit gains.

Price action has broken above 38.2% Fib retracement (0.5960) and breakout at 21-EMA will see further upside.

Failure to break 21-EMA resistance and retrace below 5-DMA negates any bullish bias.

Focus shall be on the coronavirus data for near-term direction. US Michigan Consumer Sentiment may offer additional volatility.

Support levels - 0.5857 (5-DMA), 0.5772 (23.6% Fib)

Resistance levels - 0.6016 (21-EMA), 0.6112 (50% Fib)

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential