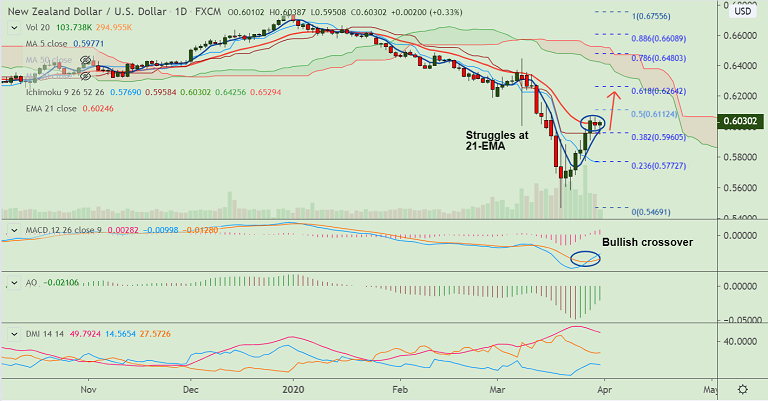

NZD/USD chart - Trading View

NZD/USD has resumed upside after the brief pause on Monday's trade, bias remains bullish.

The major was trading 0.29% higher on the day at 0.6029 at around 06:00 GMT, after closing 0.50% lower in the previous session.

The Kiwi was better bid after Upbeat China PMI which helped NZD/USD recover from the initial mini-flash crash.

Upbeat China data is likely to ease fears regarding a deeper coronavirus-led economic slowdown across the globe.

Risk-tone across markets also remains mildly positive supporting further upside in the pair.

Technical indicators still support upside. Major trend is bearish, but break above 21-EMA could see more upside momentum.

'Death Cross' (bearish 50-DMA crossover on 200-DMA) could limit upside. Rejection at 21-EMA will see downside resumption.

Breakout at 21-EMA will see next immediate hurdle at 0.6112 (50% Fib). Break above eyes 61.8% Fib at 0.6264.

Support levels - 0.5977 (5-DMA), 0.5833 (200H MA)

Resistance levels - 0.6112 (50% Fib), 0.6264 (61.8% Fib)

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts