NZD/USD chart - Trading View

NZD/USD was trading 0.23% lower on the day at 0.6118 at around 09:40 GMT.

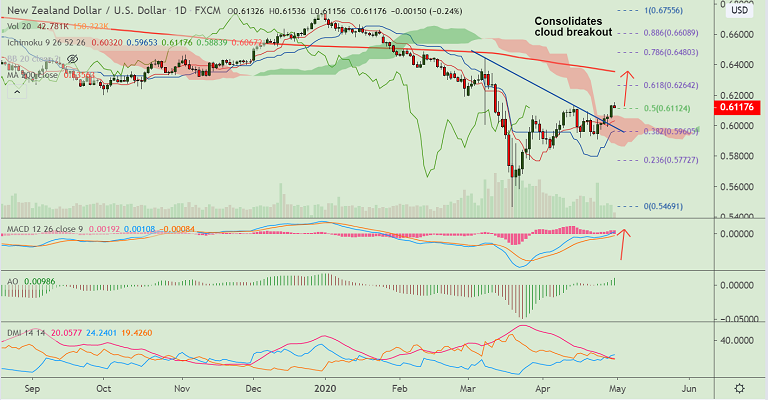

The pair is likely consolidating previous session's gains, bias higher as long as pair holds above daily cloud.

Antipodeans weaken across the board after softer-than-expected China PMI data.

National Bureau of Statistics (NBS) report earlier today showed China December Caixin manufacturing PMI came in at 49.4 vs. 50.1 last.

Meanwhile, purchasing managers' index (PMI) for China's manufacturing sector arrived at 50.8 in April, while Non-Manufacturing PMI rose from 52.3 prior to 53.2.

On the other hand, the ANZ Business Confidence for New Zealand, for April, recovered from -69.5 expected to -66.6 but Activity Outlook dropped below -26.7% previous mark to -55.1%.

Cloud breakout has raised scope for further upside in the pair. Momentum studies are bullish.

Resumption of upside will see test of 61.8% Fib at 0.6264. Retrace below 55-EMA to see weakness. Breach below cloud confirms bearish resumption.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms