NZDUSD continues to gravitate slowly towards 0.6900, thanks to a firmer US dollar since late March.

The pair in medium term perspective: Potential for higher to the 0.7150-0.7300 area during the month ahead, as USD longs are paired. Further out, the Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD down towards 0.6900.

Weaker dairy prices plus the RBNZ’s emphatic reminders it is on hold for a long time should also weigh. In New Zealand, business confidence dipped and credit conditions stayed tight.

Option Trade Recommendations:

Moreover, all these factors are discounted in FX options market. You could make out this in mounting risk sentiments as you could see the positively skewed IVs in OTM call strikes.

The NZD volatility market normalized sharply (you could observe that in NZDUSD IV skews across all tenors) and IV skewness is quite favorable for OTM put option holders.

Well, these positive skews in 2m implied volatilities signify hedging interests in downside risks and the combination of IV 3-6m skews suggests RKO calls on both hedging as well as speculative grounds, the NZDUSD 2-3m skew has been well bid with Fed’s hiking expectations in June meeting and global commodity price turbulence.

Initiate long in a 4-month NZDUSD 0.64 vanilla put.

Initiate long in a 4-month NZDUSD 0.64 put with a KO of 0.7559 calls in AUDUSD.

Short a 2-month NZDUSD AED call, strike 0.7095, buy a 2-mo AED put, strike 0.6641.

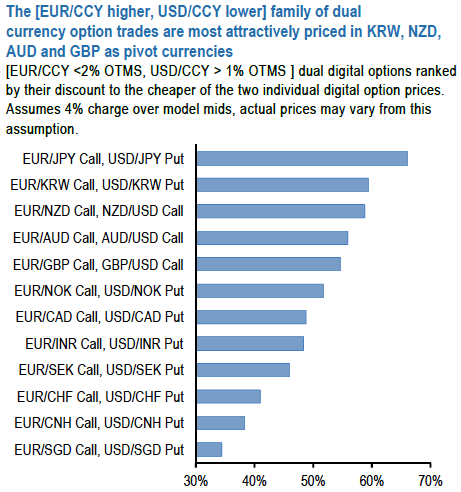

While the baskets of EUR-crosses that rally alongside EUR/USD do not offer much by way of correlation savings since EUR based correlations have climbed appreciably this year. The above chart runs through a pricing exercise of this family of structures across various pivot currencies and shows that KRW, NZD, and AUD offer the best value.

Since the broad dollar is trading meaningfully cheap to rate differentials, USD legs in this set-up need be struck more conservatively (ATMS) than the EUR-cross.

2M [EURNZD > 1% OTMS, NZDUSD > ATMS] dual digital costs 15.2/18.7% NZD indic. (indiv. digis 44.3% and 52.8% respectively).

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?