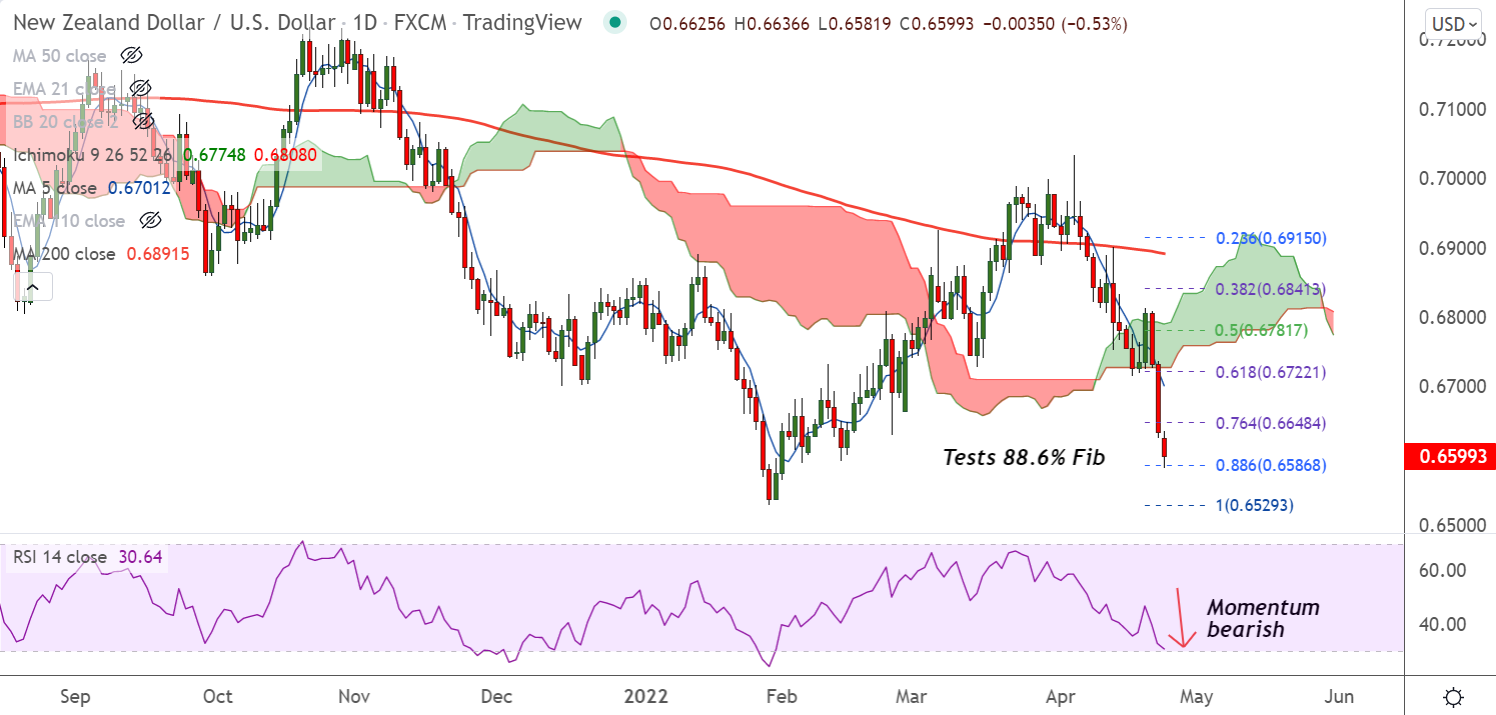

Chart - Courtesy Trading View

NZD/USD snapped a three day bearish streak and was trading 0.29% higher on the day at 0.6633 at around 09:55 GMT.

Broad risk-off move last week dragged most APAC currencies lower versus the USD. The kiwi largely ignored RBNZ rate hike bets and NZD/USD closed below 200-week MA last week.

Softer metal prices, on account of stronger US Dollar and demand concerns amid renewed Covid lockdowns in China continue to weigh.

Technical analysis for the pair remains bearish, but oversold oscillators may cause some pullbacks.

The pair has bounced off 88.6% Fib with a 'Hammer' formation, break below to see more weakness

Momentum is strongly bearish, Stochs and RSI are sharply lower. Upside finds stiff resistance at 200-DMA.

Recovery attempts lack traction. The pair is set to extends previous week's close below 200-week MA.

Major Support and Resistance Levels:

Support - 0.6586 (88.6% Fib), Resistance - 0.6684 (5-DMA)

Summary: NZD/USD recovery lacks traction, bearish remains bias. Scope for test of yearly low at 0.6570.