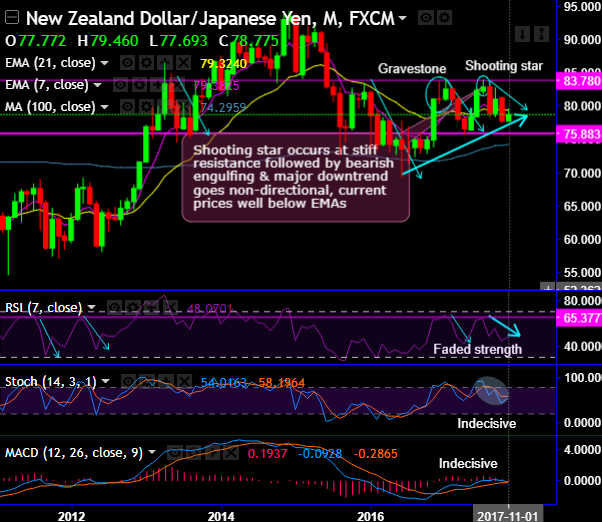

The upswings of this pair are restrained below stiff channel resistance at 79.460 levels, that’s where shooting star has occurred at 79.351 levels in the past.

Last week, the bullish engulfing pattern has occurred at 79.287 levels but bears have disregarded this bullish pattern as the above stated stiff resistance has acted as the strong price supply zone.

The previous month bears resume with the bearish engulfing pattern that takes the current prices below EMAs but this month’s price action has bounced back to restrain at the same EMA levels.

The minor trend has been sliding in the sloping channel, while both leading oscillators converge downwards for now when prices are sliding within this channel, signal overbought pressures as and when this channel resistance is rejected. In the short term trend, the bulls test support at channel baseline but the rallies are not convincing.

For now, can bears plummet more slumps as it constrains below 7DMA is what should be closely watched?

The major resistance 1 and resistance 2 are seen at 77.474 and 79.491 levels respectively that’s where, historically, the trade sentiments have seen supply zone.

RSI converges to the ongoing price dips as this leading oscillator trending below 44 levels on dailies and 48 levels on monthly terms which is a caution for aggressive bulls.

Although stochastic oscillator has been indecisive, the bearish momentum in the selling sentiments is intensified.

Overall, the prevailing bearish sentiments are mounting to signal weaker trend below 78-78.50 zone, and the major downtrend has now been in non-directional phase.

Hence, we recommend shorting rallies on speculative grounds and decide to buy tunnel spreads using upper strikes at 78.796 and lower strikes at 78.280 levels.

This strategy is likely to fetch leveraged yields than spot FX and certain yields as long as underlying spot FX keeps dropping.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards -129 levels (which is highly bearish), while hourly JPY spot index was at shy above -6 (neutral) while articulating (at 08:26 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: