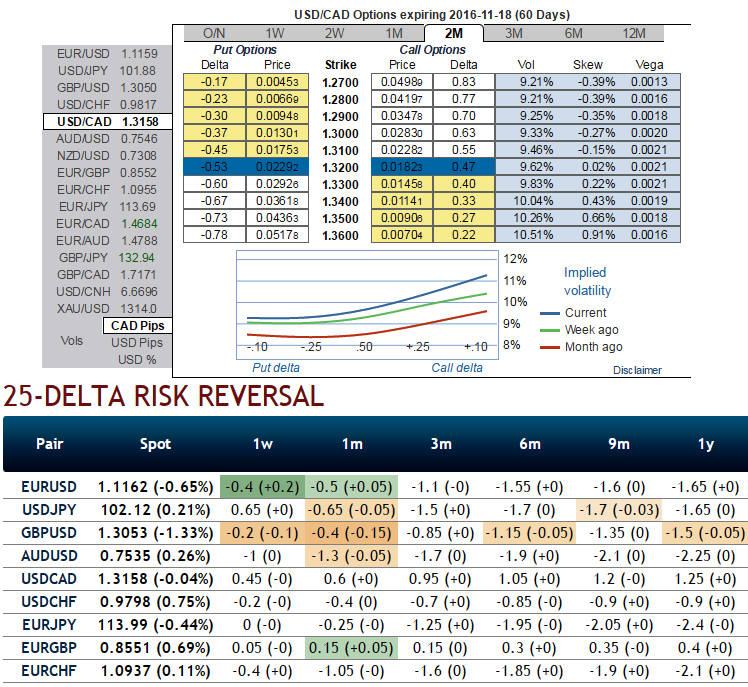

Mounting positive skews in 2m implied volatilities suggests RKO calls, the USD/CAD 2-3m skew has been bid with Trump progresses in the polls, lifting it to its highest level since June 2015.

This increases the implied probability that USDCAD would trade at a higher level so that a topside KO barrier would massively discount the cost of a vanilla call.

From the nutshell showing delta risk reversals of USDCAD, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts which indicate upside risks of spot FX is anticipated and hedging for such risks is relatively more expensive.

We set a KO at 1.40, a level very unlikely to be met in the next two months as the spot visited higher levels only when the oil prices collapsed below $30/bbl in January, a development highly unlikely from the current $45-50 range.

The 2m tenor is appropriate as the option expires in mid-November, capturing the market reaction of the week following the 8 November election, and hedging the immediate reaction to a Trump victory for three times less than the vanilla cost.

The execution: at spot ref: 1.3170, bidding on 3m risk reversals, initiate longs in USDCAD 2m call strike 1.34 knock-out 1.40 Indicative offer: 0.27% (vs 0.93% for the vanilla).

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges