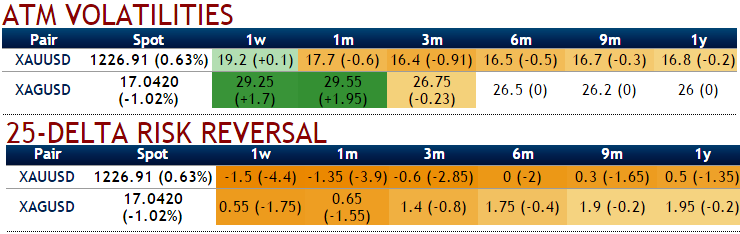

The ATM IVs of silver of 1w-1m expiries are spiking higher crazily, 1m IVs are shy above 29.50% that encompasses Feds rate hike speculations (as we get closer to December, the investors are currently pricing higher chances of a rate hike at the Fed's December monetary policy meeting).

While extremely negative delta risk reversal flashes higher numbers that signify OTC bullion is more concerned about bearish risks of silver prices in this course of time.

On the Comex, silver prices for December delivery rose 9.0 cents, or 0.53%, to $16.98 a troy ounce during morning hours in London, bouncing back after dropping to $16.62 on Monday, the lowest since June 8.

Since 1m IV is on the higher side with extremely bearish hedging sentiments, it implies that the bullion market reckons the price has more potential for large movement southward direction. The precious metal is sensitive to moves in U.S. rates, which lift the opportunity cost of holding non-yielding assets such as bullion while boosting the dollar in which it is priced.

Additionally, the momentum in bear trend is gaining more traction, but from the last couple of weeks the strength amid growing concerns over global risk sentiments, this sentiment is now changing.

Hence, as shown in the diagram, hence, we recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of ITM call (1%) with comparatively shorter expiry in the ratio of 2:1.

We encourage -0.49 ATM delta puts in our strategy, as the ATM contracts are more expensive and gamma/vega sensitive than OTM contracts, but cheaper than ITM options. They have the highest Gamma, Vega, and Theta which means their premium is the most sensitive to moves in either direction.

So, trading option spreads in ATM and ITM strikes allows the traders in many puzzling market scenarios and likely to fetch not only positive cashflows as you could see the payoff structure but also the cost advantage.

The higher strike short puts seems little risky but because IV responds adversely (bets on RR and current downswings in underlying price to prevail), the likelihood of options expiring in the money is very less and it finances the purchase of the greater number of long puts (ATM calls are reasonably priced, so we loaded up with the weights in the spreads) and the position is entered for reduced cost.

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch