Sterling continued its bearish streaks owing to the driving forces of augmented apprehensions about the UK leaving the EU without an agreement (“no deal Brexit”).

In this context, the argument that a feeble currency would back-up the export sector and thus the economy. However, the hitch is that this positive effect on trade flows takes some time to come into force. The depreciation is going to make imports more expensive, as the UK’s dependence on food imports from the EU is likely to rise.

As a result, GBP remains under pressure across the board, as the market increasingly ‘prices’ a higher chance of a ‘no deal’ Brexit. Almost all the major GBP pairs are heading for 1-year lows. The key levels to monitor are: 1.2850 (and then 1.2780-1.2600) in GBPUSD, 0.9040 (and then 0.9160-0.9300) in EURGBP and 141.70 (and then 141.20-139.20) in GBPJPY.

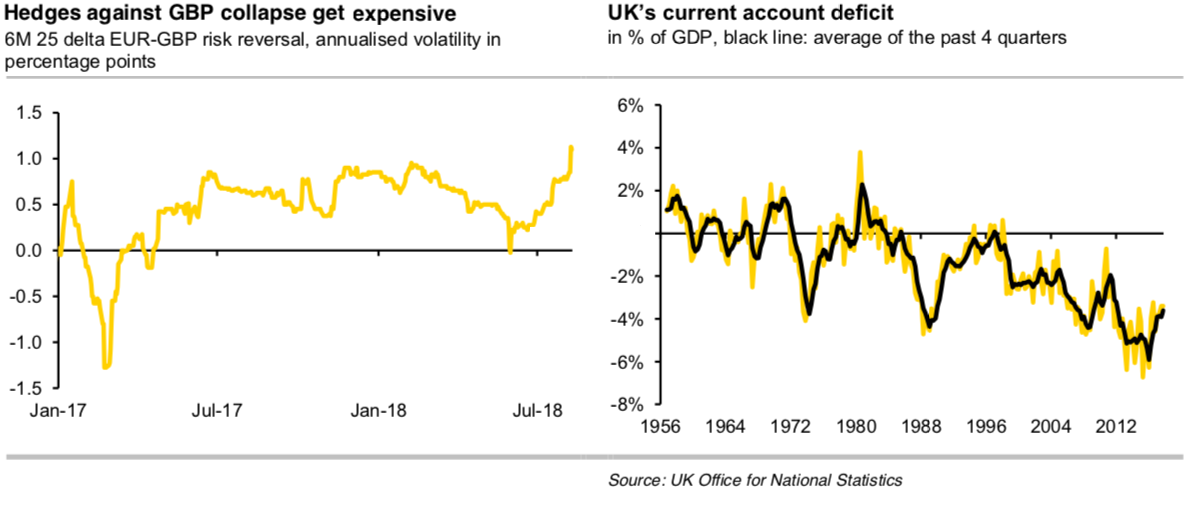

This is reflected above all in the options market where hedging against a collapse of Sterling has become much more expensive (refer 1stchart for EURGBP risk reversals) – with the prices still being a long way off the 2016 highs though.

However, what is worrying about yesterday’s move is the fact that there was no obvious trigger for it, which to my mind constitutes a warning sign that the Sterling weakness might develop self-reinforcing tendencies. In such a case, an acceleration of the downtrend would have to be expected, exactly the worst-case scenario for Sterling that we have been warning about since the Brexit referendum.

After all, for the individual investor it is no longer decisive at this juncture whether they themselves still believe in an amicable agreement between London and Brussels but what they think all others expect - at least if they want to avoid being the last ones to square their GBP investments (at even lower prices at that point). The fact that Great Britain records high current account deficits (see 2ndchart) and therefore requires constant capital imports to finance these, clearly makes the situation worse.

In case of the capital flows drying up or even a capital flight the current account would have to be adjusted which would of course be more painful for the economy the higher the capital requirements are. The result would be a deep economic crisis.

All these bearish driving forces seem to be factored-in OTC markets. Please be noted that the positively skewed IVs of 2m tenors signify the bearish hedging interests to bid OTM put strikes upto 124 levels (refer above nutshell evidencing IV skews).

As you could observe the above-nutshell evidencing risk reversals of sterling (GBPUSD and EURGBP) is signalling extreme bearish risks across all tenors, bearish risks remain intact even in the long-run (refer risk reversal table).

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -50 levels (which is bearish), while hourly USD spot index was at -8 (absolutely neutral) and EUR is at 74 (bullish), while articulating (at 10:35 GMT). For more details on the index, please refer below weblink:

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty