AUDUSD bears resume their business after brief rallies, broader downside risk outlook remains intact, one could foresee the next target up to 0.70 or even below those levels in near term.

While the medium-term perspective: Needless to specify that the FOMC’s dovish rhetoric might have driven AUD towards 0.73 areas while the RBA’s subsequent switch to neutral produced multi-week lows around 0.70 levels.

Amid this monetary policy turbulence, AUDUSD has sensed minor shift with positive bids is observed to the major bearish hedging outlook.

It is unwise to isolate this indication and jump the guns, if at all, anyone is holding AUDUSD call spreads with the optimism that USD would come under modest pressure in the wake of the dovish FOMC and that AUD was well placed to capitalize on this given the already inverted slope of the Australian yield curve, it is wise to insulate AUD rates from the inevitable re-think of global monetary policy.

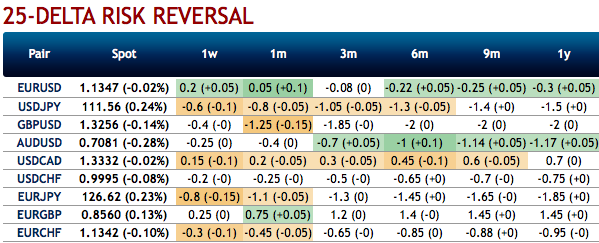

Most importantly, let’s just quickly glance through AUD’s other parameters of OTC markets also. The bearish risk reversals coupled with IV skews of this pair across all tenors still indicate downside risks remain intact. While the implied volatilities (IV) are also shrinking below 8% for 1m – 3m tenors which are not conducive for call options holders. As a result, good to unwind the call options positions.

Meanwhile, Australia’s key export prices have bounced, and US-China trade talks seem likely to result in some form of deal. Westpac’s new view of two RBA rate cuts in H2 obviously hurts the Aussie but data isn’t likely to stoke much more pricing of rate cut risk before August.

Benefiting from the shift in the monetary policy sentiments seemed unjustifiable, as especially the RBA, which unexpectedly dropped its implicit tightening bias and thereby allowed the domestic market to more fully price a rate cut over the coming year.

Chances are that the market will bring forward its pricing for ease unless the domestic data improves quickly, and so whereas last week we believed there was value holding this trade as a low-delta option on resolution to US-China trade conflict, this week we take losses and exit the trade as it seems that the domestic policy risks to AUD are liable to intensify.

The danger now for AUD is that it starts to decouple from other high-beta assets, and if so there is likely to be value in using AUD to fund exposure in other high-beta currencies to benefit from either an early stage pick-up in global growth or de-escalation of a trade conflict. Potential de-correlation trades include selling AUDUSD calls to fund selective long EM exposure or owning hybrid options such as dual digitals with AUD lower/US equities higher.

On hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.70 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 51 levels (which is bullish), while hourly USD spot index was at 57 (bullish) while articulating (at 08:24 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms